Learn more about books with this collection

How to manage risk

How to analyze investment opportunities

The importance of long-term planning

P/E Ratio (Price per Earning)

Let's say that a company's stock trades for $100 and that the company has earnings per share (EPS) of $6.50 over the last 12 months.

We can calculate a trailing ("last 12 months") P/E ratio for that stock by simply dividing the stock price ("P") by the EPS ("E"), so 100/6.50 equals about 15.

We can say that this stock has a TTM P/E (trailing 12 months price to earnings ratio) of 15. Historically that is a pretty good average P/E for stock or for the stock market as a whole.

1.83K

4.74K reads

MORE IDEAS ON THIS

How much to invest in growth stocks

Risk no more than 1% of the trading account on each stock trade.

Let’s say that I am trading a $100,000 account. I will risk only 1% of my account, or $1,000. If I enter the stock at 100 and the 50-day moving average is at 95, that means that my risk is 5 points on the stock (100-95). ...

1.86K

3.84K reads

Growth Stocks

Great companies that are rapidly growing will always trade at high P/E's (Facebook, Amazon etc). Value investors will always tell you to stay away from companies with high P/E's. Ignore them.

Matthew's advice: buy growth stocks that are hitting new 52-week highs, or even all-time n...

1.81K

4.59K reads

Investing is for everyone

Investing is not magic. Remember that ...

- most people don't invest at all

- 75% of new traders quit within the first 3 months.

- 90% of new traders quit within the first 6 months.

If you can stick around long enough and keep learning, you will be successful at...

1.95K

14.9K reads

How to find growth stocks

Find stocks with the following characteristics:

- price at 52wk highs or new all-time highs

- stock is trading above its 50day moving average and the 50day moving average is above the 200day moving average

- trends upwards after a earning report

- markets are up (usin...

2K

4.04K reads

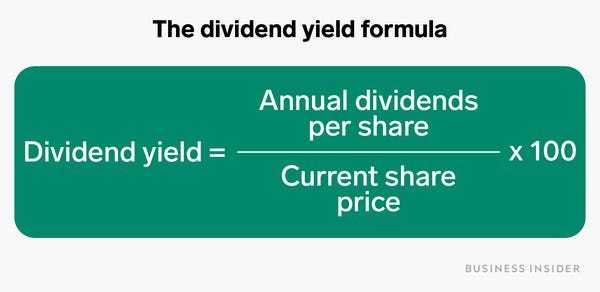

Dividend Stocks

A dividend stock will usually make a cash payment into your brokerage account every 3 months. Works well as you can take the cash from a dividend payment and use it to buy more dividend stocks.

A dividend yield is how much money you make yearly compared to the share price (see image): ...

1.8K

5.55K reads

When to sell a growth stock

Get out:

- when a stock moves up 100% in 2 weeks or less

- when you are up 300% from your entry price

- when all of your friends and CNBC begin to talk a lot about it

- when the stock closes below its 50day or 200day moving average

- when the stock has a daily clo...

1.97K

4.46K reads

The technicality of buying a stock

Every stock has a bid price and an offer (or "ask") price. “You sell to the bid, and you buy from the ask.”

When you are buying a stock, you can use 2 different kinds of orders:

- market order: this order tells the broker to get you into the stock...

1.76K

8.81K reads

Trading ETFs (exchange-traded fund")

An index is simply a collection (or "basket") of stocks. An ETF allows trading an index just like a stock. The best-known indexes are:

- S&P 500 (trading as SPY): the 500 U.S. stocks with the largest market caps

- Dow Jones Industrial Average (tra...

1.81K

6.73K reads

1.71K

7.53K reads

The big 5 beginner investing mistakes

- Don’t buy stocks that are hitting 52-week lows. You are most likely catching a falling knife.

- Don’t trade penny stocks. They are mostly scams.

- Don’t short stocks. You will probably get burned.

- Don’t trade on margin. Don't borrow to buy stocks. You may lose your hous...

1.9K

5.33K reads

Active vs Passive Investing

Active investing strategies means picking your own stocks and building and managing a portfolio. It's hard and few people do it well.

Passive investing strategies mean investing in an index. When indexing, most people like to invest the same dollar amount ...

1.79K

6.55K reads

Value Investing

Popularized by investors Benjamin Graham & Warren Buffett, value investing is about buying something for less than it is worth. It's based on this idea that you can find undervalued companies (companies with low P/E - price per earnings). It's hard to do it these days:

- Finding underval...

1.79K

5.25K reads

Stock Exchanges

It's where shares in companies are traded. The most important ones are:

- NYSE (New York Stock Exchange) - known for "blue chip" stocks like Coca-Cola . Companies here are identified by 2 letters tickets (KO for Coca Cola)

- NASDAQ - known for tech stocks like Apple. The tickets he...

1.78K

9.06K reads

CURATED FROM

CURATED BY

Life-long learner. Passionate about leadership, entrepreneurship, philosophy, Buddhism & SF. Founder @deepstash.

Related collections

More like this

How growth investors can use variations of the P/E ratio

Growth investors often use the P/E ratio as a building block for finding two other metrics: the forward P/E and the PEG ratios.

- The forward P/E is calculated by dividing the stock price by the company's expected future earnings.

- The PEG ratio is calculated by dividing the comp...

The cornerstone to valuing stocks: The P/E ratio

The go-to metric for nearly all investors when it comes to valuing a stock has to be the P/E ratio. Standing for price-to-earnings, this formula is calculated by dividing the stock price by the earnings per share (EPS). The lower the P/E ratio, the more earnings power investors are buying with ea...

The Price Sales Ratio

While using the P/E ratio as a building block is probably the most popular method to value stocks it is far from the only way. Another common technique to valuing stocks is the price/sales ratio. The P/S ratio is determined by dividing a company's market cap -- the total value of all the companie...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving & library

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Personalized recommendations

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates