Learn more about moneyandinvestments with this collection

How to create and sell NFTs

The future of NFTs

The benefits and drawbacks of NFTs

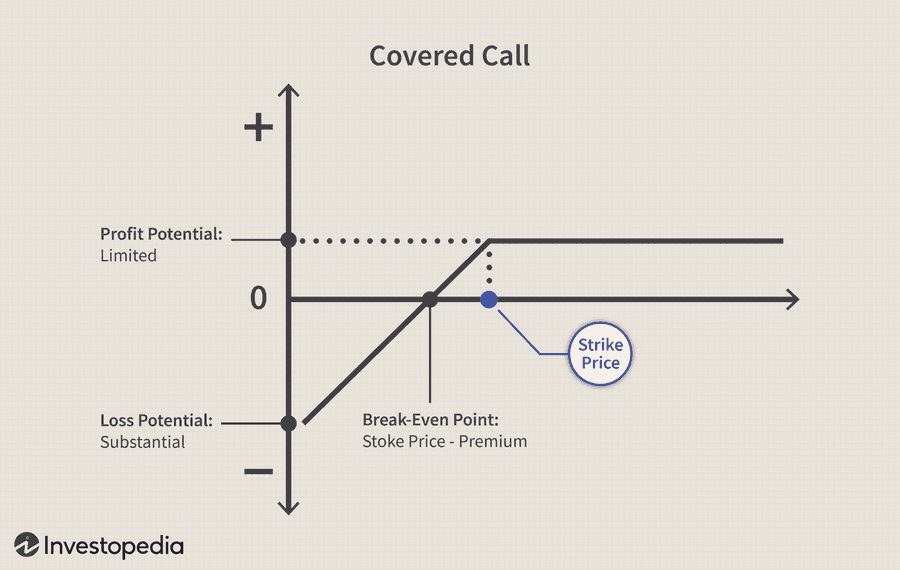

Suppose a trader buys 1,000 shares of BP (BP) at $44 per share and simultaneously writes 10 call options (one contract for every 100 shares) with a strike price of $46 expiring in one month, at a cost of $0.25 per share, or $25 per contract and $250 total for the 10 contracts. The $0.25 premium reduces the cost basis on the shares to $43.75, so any drop in the underlying down to this point will be offset by the premium received from the option position, thus offering limited downside protection.

140

222 reads

MORE IDEAS ON THIS

Forms of trading

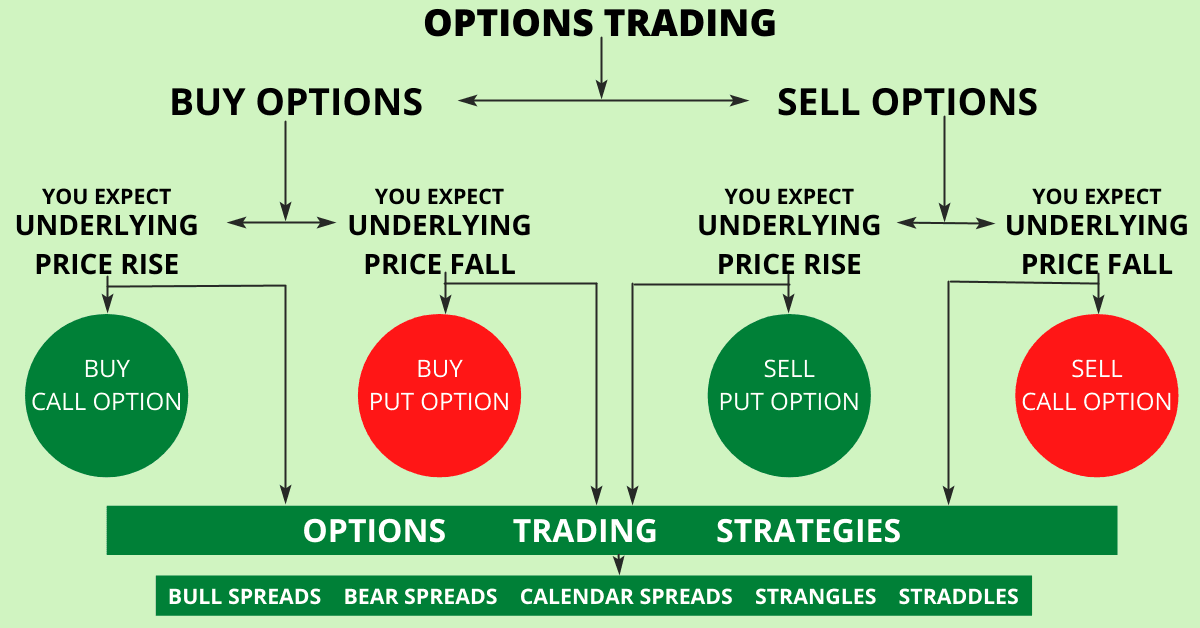

Options are divided into "call" and "put" options. With a call option, the buyer of the contract purchases the right to buy the underlying asset in the future at a predetermined price, called

165

1.1K reads

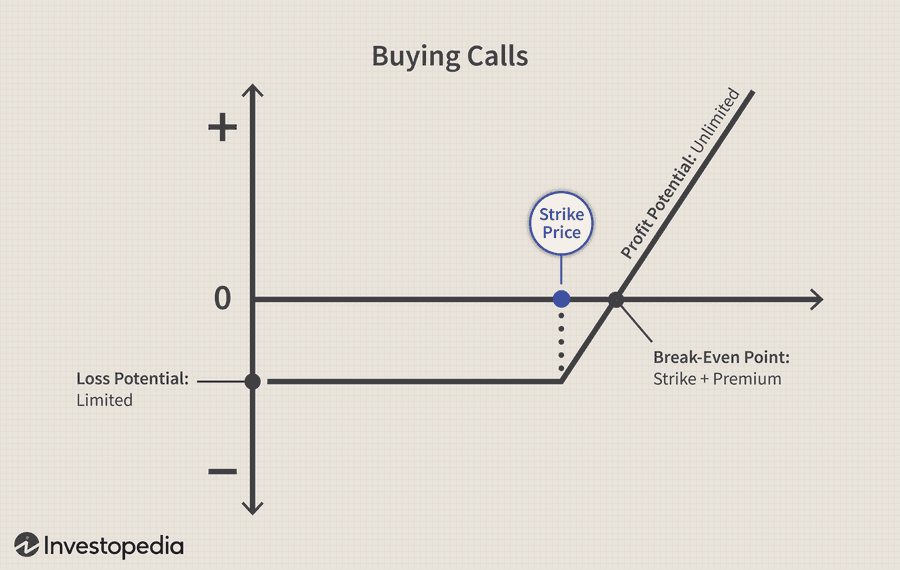

Buying Calls (Long Call)

Suppose a trader wants to invest $5,000 in Apple (AAPL), trading around $165 per share. With this amount, they can purchase 30 shares for $4,950. Suppose then that the price of the stock increases by 10% to $181.50 over ...

140

519 reads

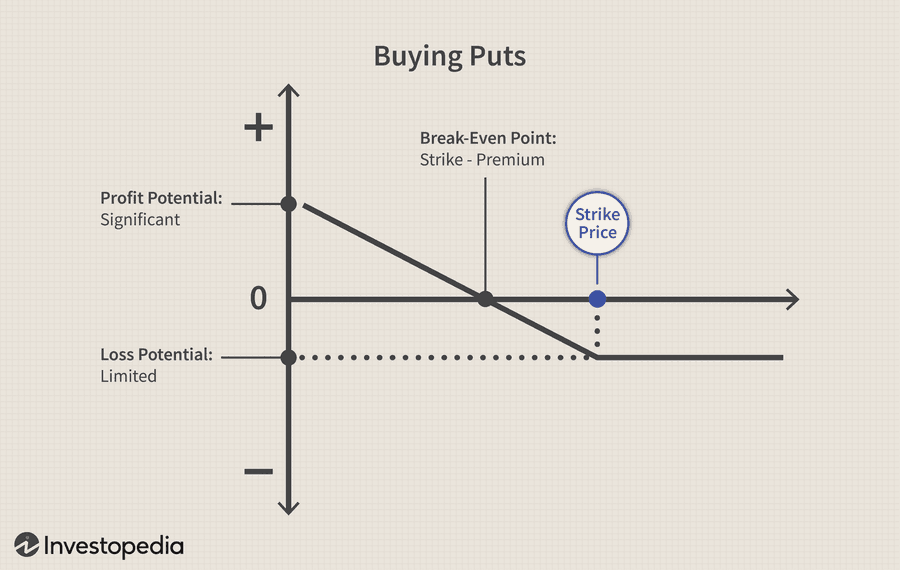

Buying Puts (Long Put)

A put option works the exact opposite way a call option does, with the put option gaining value as the price of the underlying decreases. While short-selling also allows a trader to profit from falling prices, the risk with a short position is unlimited, as there is theoretically no limit on how ...

143

235 reads

Covered Call

A covered call strategy involves buying 100 shares of the underlying asset and selling a call option against those shares. When the trader sells the call, the option's premium is collected, thus lowering the cost basis on the shares...

141

285 reads

Why Trade Options Rather Than a Direct Asset?

There are some advantages to trading options. The Chicago Board of Options Exchange (CBOE) is the largest such exchange in the world, offering options on a wide variety of single stocks, ETFs and indexes.1

Traders can construct option strategies ranging from buying or selli...

143

586 reads

Definition and application

Options are conditional derivative contracts that allow buyers of the contracts (option holders) to buy or sell a security at a chosen price. Option buyers are charged an amount called a "premium" by the sellers for such a right. S...

151

1.13K reads

140

212 reads

However, this example implies the trader does not expect BP to move above $46 or significantly below $44 over the next month. As long as the shares do not rise above $46 and get called away before the options expire, the trader will keep the premium free and clear and can continue selling calls a...

140

211 reads

Now, let's say a call option on the stock with a strike price of $165 that expires about a month from now costs $5.50 per share or $550 per contract. Given the trader's available investment budget, they can buy nine options for a cost of $4,950. Because the option contract controls 100 shares, th...

144

452 reads

CURATED FROM

CURATED BY

Related collections

More like this

Covered Call

A covered call strategy involves buying 100 shares of the underlying asset and selling a call option against those shares. When the trader sells the call, the option's premium is collected, thus lowering the cost basis on the shares...

Now, let's say a call option on the stock with a strike price of $165 that expires about a month from now costs $5.50 per share or $550 per contract. Given the trader's available investment budget, they can buy nine options for a cost of $4,950. Because the option contract controls 100 shares, th...

Buying Calls (Long Call)

Suppose a trader wants to invest $5,000 in Apple (AAPL), trading around $165 per share. With this amount, they can purchase 30 shares for $4,950. Suppose then that the price of the stock increases by 10% to $181.50 over ...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving & library

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Personalized recommendations

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates