The Three Main Pairings

There are six main components (or three pairings) to the formula for investment success:

- Pair 1: Cycle Positioning and Asset Selection

- Pair 2: Aggressiveness and Defensiveness

- Pair 3: Skill and Luck

528

1.77K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to create a diversified portfolio

How to analyze stocks and bonds

Understanding the basics of investing

Related collections

Similar ideas to The Three Main Pairings

Why to avoid laziness and walk towards learning

The main management skills needed for success are:

1. Management of cash flow

2. Management of systems

3. Management of people

Five main reasons why financially literate people may still not develop abundant asset columns that could ...

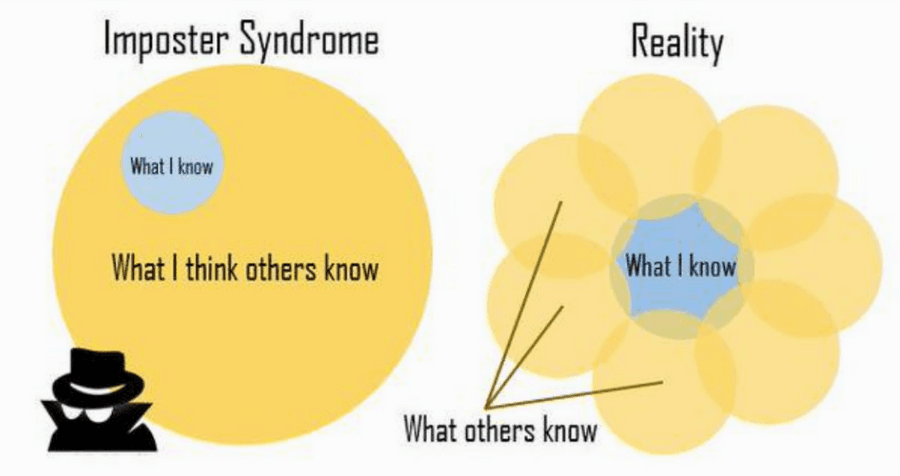

The Impostor Syndrome

It is the feeling that you are not worthy of your designation, title, position or success.

Your accomplishments may be due to luck or effort, but you feel you lack the talent or skill for them.

The Three Levels Of The Polyvagal Theory

Our nervous system, specifically the vagus nerve, regulates threat and stressful situations, with a three-part response:

- Level 1 - Immobilization: Reptiles, mammals and humans can suddenly become immobile when faced with a dire threat.

- Level 2 - Mobi...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates