Pay yourself first

This method prioritises savings before immediate expenses.

Decide how much to put towards your monthly savings goals like retirement and an emergency fund, then use what is left.

48

518 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to create a diversified portfolio

How to analyze stocks and bonds

Understanding the basics of investing

Related collections

Similar ideas to Pay yourself first

Pay Yourself First

Prioritise your savings, not saving what is left after spending.

When budgeting, consider what is necessary to cover your basic needs, then figure out how much you want to save. The leftover is spending money. If it helps, think of your savings and investments as a monthl...

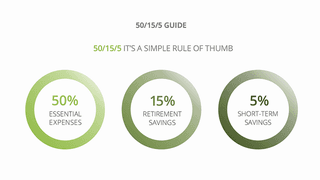

The 50/15/5 rule for multiple financial goals

- 50% of your income goes toward essential expenses: rent, bills, minimum debt payments.

- 15% percent goes to retirement savings. They also suggest you increase this by 1% each year.

- 5% goes toward unexpected monthly expenses or building an emergency...

Focus on...

- Building an emergency fund: set up an automatic weekly or monthly transfer from your checking account to your savings, then leave the savings alone until an emergency appears.

- Eliminating high-interest debt: Set up a simple debt repayment plan by organizing your debts b...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates