The Impact of Uncertainty on Investing

Any time you put money at risk in an attempt to profit, there is an inherent level of uncertainty. When new threats such as war or recession arise, the level of uncertainty increases significantly as companies can no longer accurately predict their future earnings.

As a result, institutional investors will reduce their holdings in stocks considered unsafe and move the funds to other asset classes like precious metals , government bonds, and money-market instruments. This sell-off, which occurs as large portfolios reposition themselves, can cause the stock market to depreciate.

12

108 reads

CURATED FROM

IDEAS CURATED BY

Budgeting in tuff times

“

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

Understanding the basics of cryptocurrency

How to store cryptocurrency securely

Risks and benefits of investing in cryptocurrency

Related collections

Similar ideas to The Impact of Uncertainty on Investing

The impact of tech on the Buffet indicator

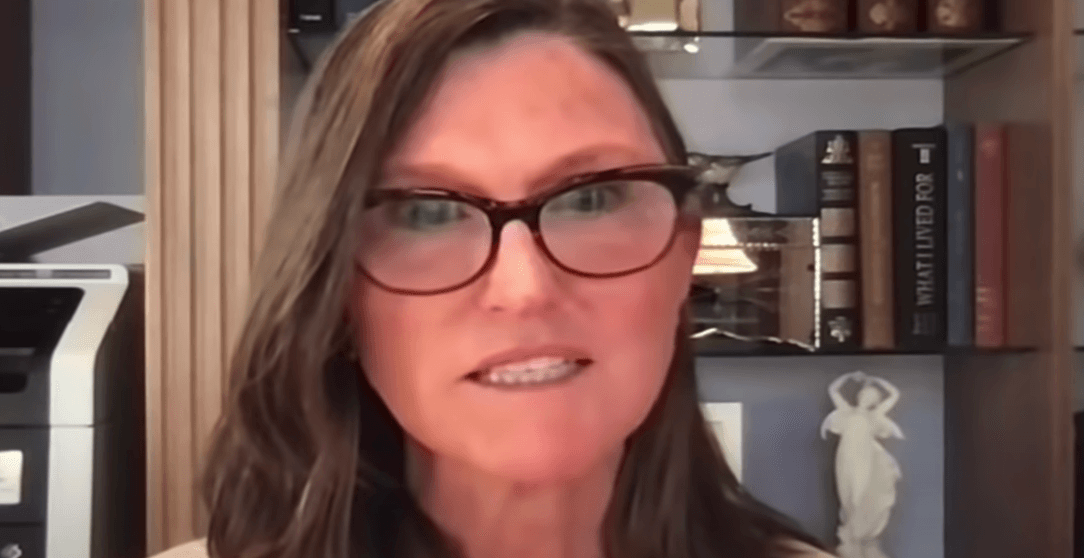

In 2021, Elon Musk asked Cathie Wood, the famous tech-focused investor from Ark investments, what is her explanation for the high Buffet indicator (a ratio of US stock market/GDP). Cathie suggests a few reasons:

- while the indicator maintained its pattern over the last 100 years,

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates