Your Savings (20%)—

The remaining 20% of your income should be dedicated to savings, which includes building an emergency fund, investing for retirement, paying off debts, or saving for future goals like buying a house or starting a business. This portion helps secure your financial future and grants you peace of mind.

As a general rule of thumb, you should have at least 3 to 9 months of emergency savings on hand in case you lose your job or an unforeseen event occurs. After that, focus on retirement and meeting other financial goals down the road.

3

5 reads

CURATED FROM

IDEAS CURATED BY

Finance management is important, without which we will always struggle no matter how much money we make.

“

Similar ideas to Your Savings (20%)—

20%: Savings

Finally, try to allocate 20% of your net income to savings and investments. This includes adding money to an emergency fund in a bank savings account, making IRA contributions to a

Focus on...

- Building an emergency fund: set up an automatic weekly or monthly transfer from your checking account to your savings, then leave the savings alone until an emergency appears.

- Eliminating high-interest debt: Set up a simple debt repayment plan by organizing your debts b...

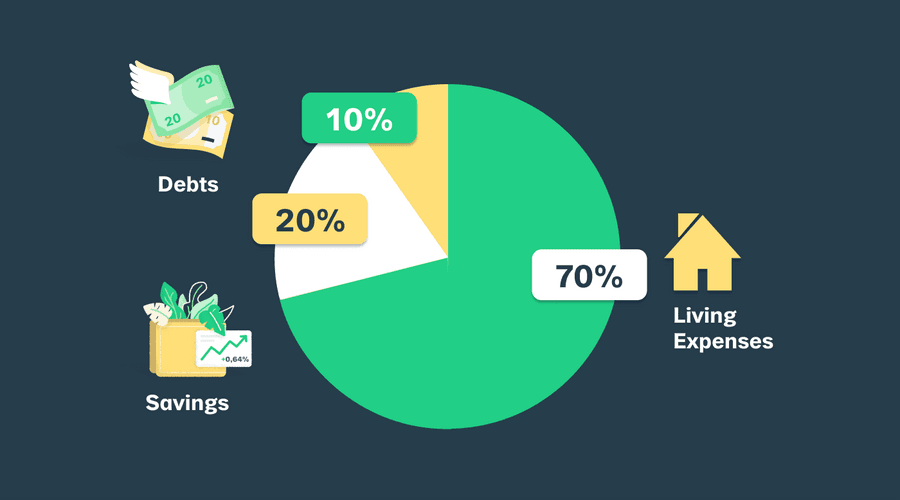

The 70:20:10 budgeting method

This method suggests that you allocate 70 percent of your income to expenses, 20 percent to savings, and the remaining 10 percent to debt.

70:20:10 may work for someone with a healthy emergency fund and minimal debt.

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates