Day 1

- Right time to start investing is TODAY.

- Don't make big decisions when reeling under debt.

- Liquidity is critical.

- Have excess cash? Wait for the right time.

- Diversify based on what works for you.

- Take loans only for things that appreciate in value.

- Live within your means always.

- When in need of money, don't break mutual funds.

- Our income is not capped but our spending can be.

- Know the value of your time.

- Avoid FOMO investing like Bitcoin.

- Start a company, own stocks, create rental income > Renting your own time.

- Take risks early on.

154

2.54K reads

CURATED FROM

IDEAS CURATED BY

Every book is a journey, and I'm here to invite you to join me on the adventure of a thousand words.

Compilation of day wise learnings from this EPIC book on health, happiness, money, habits and so much more.

“

Similar ideas to Day 1

When To Take On Debt

Debt is a liability unless you use it to finance income-generating assets. Don't take on debt for anything that does not increase in value over time.

Suitable forms of debt include buying real estate as a rental property, investing in your business, or a student loan.

Four Steps To Building Wealth

- Don’t Be a Consumerist: keep your expenses as low as possible without sacrificing the quality of life. Spend money on things that yield lasting benefits.

- Have An Emergency Fund: this gives you freedom and peace of mind to deal with issues without having to upset your lo...

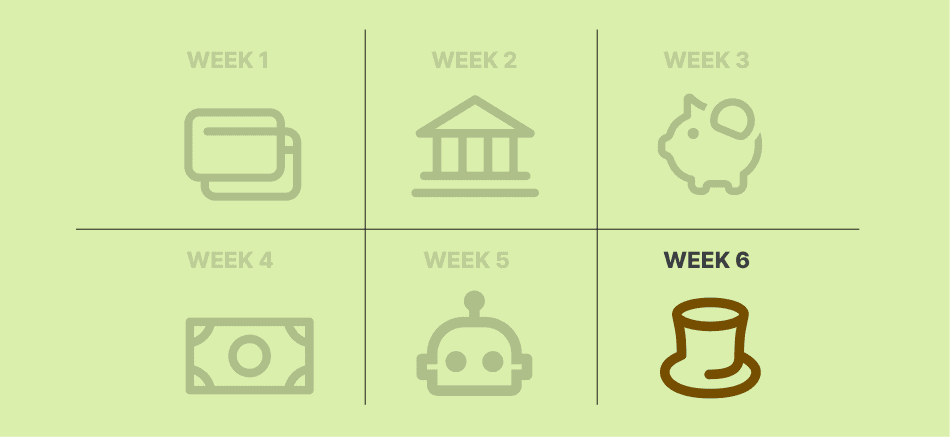

Week 6: Start Investing

Invest in index funds not individual stocks. Put your own behavioral psychology to work here. Invest automatically and over long periods of time.

Once you’ve covered the basics (aka index funds), allocate 5-7% of your income to “mental outlets.” This is money for you to inv...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates