Credit scoring

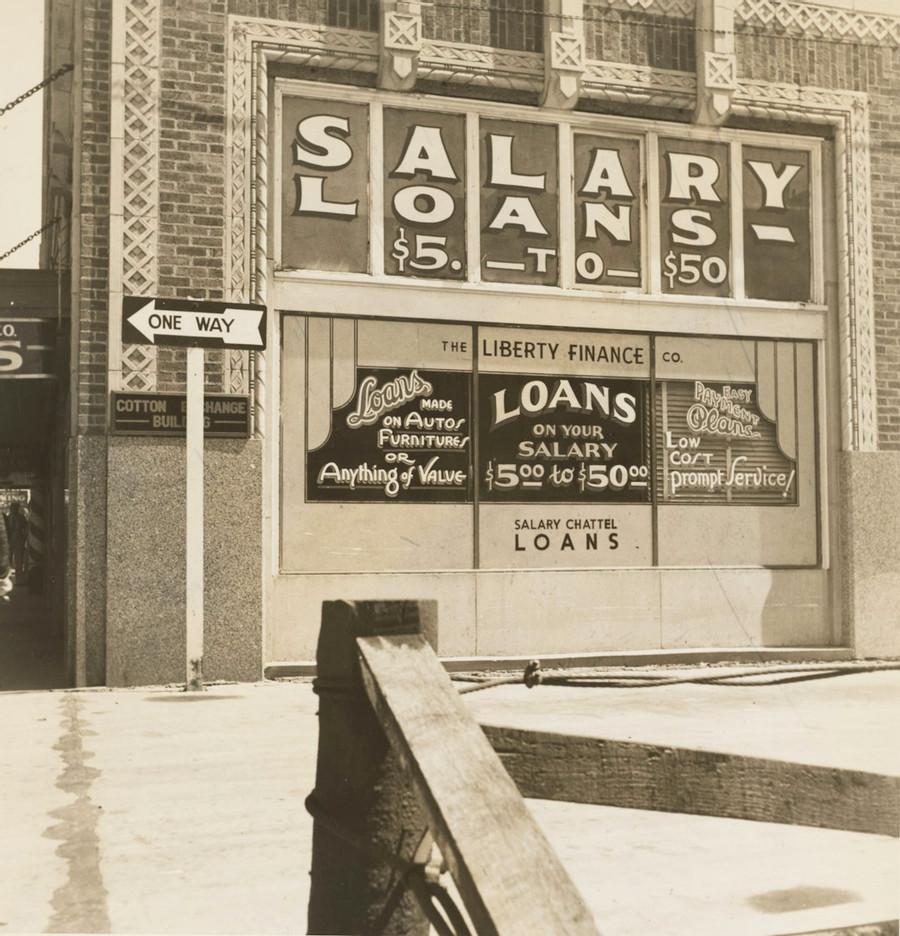

In lending and credit scoring, AI improves decision-making processes. Traditional credit scoring methods often overlook potential creditworthy candidates as it works on general rule based approach.

AI models can build more accurate models for risk assessment by considering non-traditional data points like rental payment histories and social media behaviour. This allows lenders to give loans to wider audience and manage risk effectively.

26

227 reads

CURATED FROM

IDEAS CURATED BY

Explore how AI is transforming finance

“

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates