Monetary Policy

Managed by a country's central bank (like the Reserve Bank of India in your case), it involves controlling the money supply and interest rates to manage inflation and stabilize the economy

21

149 reads

CURATED FROM

IDEAS CURATED BY

Supply: How much of a product or service is available to buy. Demand: How much of that product or service people want to buy. When supply is high but demand is low, prices go down. When demand is high but supply is low, prices go up

“

Similar ideas to Monetary Policy

The Federal Reserve

The Federal Reserve does not want to start a recession because part of its dual mandate is to keep the economy healthy. But, the Fed's dual mandate also includes keeping inflation low. A cure for rising inflation is higher interest rates, which slows the economy.

For example, in 1981, ...

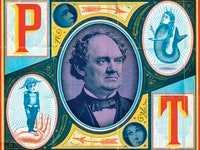

The John Law Economic System

The financial system in use today is a version of John Law’s system:

Each country in the developed world has a central bank that issues paper money, manages the supply of credit in the interest of commerce, uses fractional-reserve banking, and has joint-stock companies that pay dividends.

Federal Rates

The Fed rate is also tied to inflation, which impacts earnings, which affects consumer spending. Inflation also moves hourly wages and direct interest rates. This can create the impression that interest rates and consumer spending are more closely related than they are.

The Federal Reserve...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates