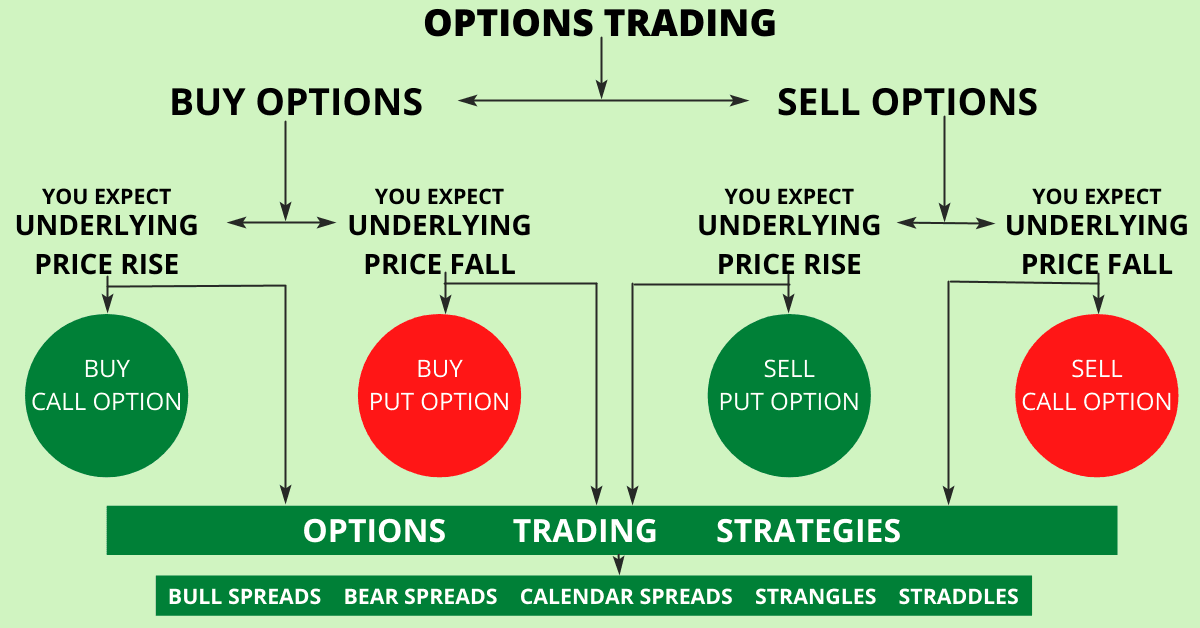

Forms of trading

Options are divided into "call" and "put" options. With a call option, the buyer of the contract purchases the right to buy the underlying asset in the future at a predetermined price, called exercise price or strike price. With a put option, the buyer acquires the right to sell the underlying asset in the future at the predetermined price.

178

1.23K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to create and sell NFTs

The future of NFTs

The benefits and drawbacks of NFTs

Related collections

Similar ideas to Forms of trading

Covered Call

A covered call strategy involves buying 100 shares of the underlying asset and selling a call option against those shares. When the trader sells the call, the option's premium is collected, thus lowering the cost basis on the shares...

Now, let's say a call option on the stock with a strike price of $165 that expires about a month from now costs $5.50 per share or $550 per contract. Given the trader's available investment budget, they can buy nine options for a cost of $4,950. Because the option contract controls 100 shares, th...

Suppose a trader buys 1,000 shares of BP (BP) at $44 per share and simultaneously writes 10 call options (one contract for every 100 shares) with a strike price of $46 expiring in one month, at a cost of $0.25 per share, o...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates