That's a net dollar return of $9,990, or 200% on the capital invested, a much larger return compared to trading the underlying asset directly. (For related reading, see "Should an Investor Hold or Exercise an Option?")

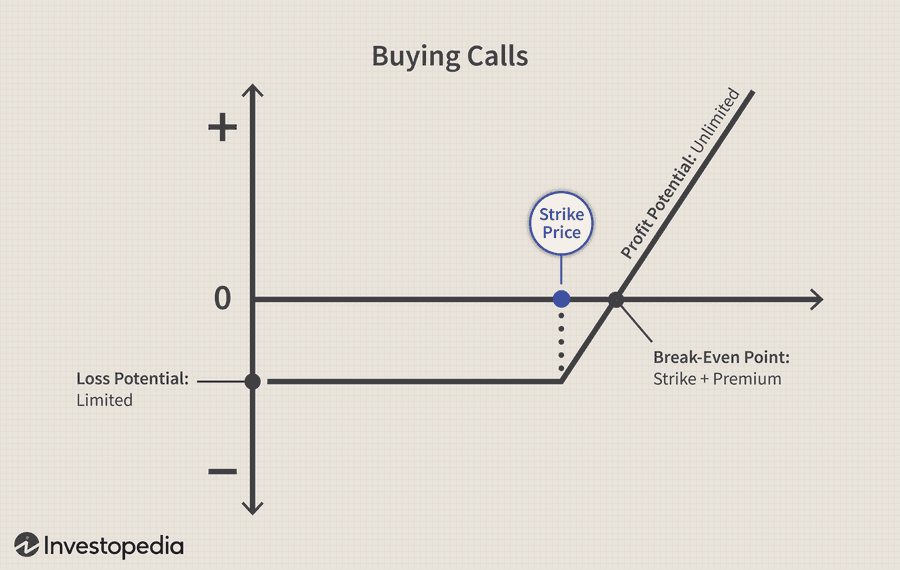

Risk/Reward: The trader's potential loss from a long call is limited to the premium paid. Potential profit is unlimited, as the option payoff will increase along with the underlying asset price until expiration, and there is theoretically no limit to how high it can go.

154

401 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to create and sell NFTs

The future of NFTs

The benefits and drawbacks of NFTs

Related collections

Similar ideasundefined

Covered Call

A covered call strategy involves buying 100 shares of the underlying asset and selling a call option against those shares. When the trader sells the call, the option's premium is collected, thus lowering the cost basis on the shares...

Buying Calls (Long Call)

Suppose a trader wants to invest $5,000 in Apple (AAPL), trading around $165 per share. With this amount, they can purchase 30 shares for $4,950. Suppose then that the price of the stock increases by 10% to $181.50 over ...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates