6 ideal investments for beginners

- If you have a 401(k) or another retirement plan at work, it’s very likely the first place you should put your money— especially if your company matches a portion of your contributions.

- A robo-advisor. These services manage your investments for you using computer algorithms and typically costs 0.25% to 0.50% of your account balance per year.

- Target-date mutual funds often hold a mix of stocks and bonds and automatically invest with your estimated retirement year in mind.

- Index funds are like mutual funds on autopilot: Rather than employing a professional manager to build and maintain the fund’s portfolio of investments, index funds track a market index.

- Exchange-traded funds. ETFs operate in similar ways as index funds: The main difference between ETFs and index funds is that rather than carrying a minimum investment, ETFs are traded throughout the day and investors buy them for a share price, which like a stock price, can fluctuate.

- Investment apps like Acorns or Stash.

881

2.42K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

Understanding the basics of cryptocurrency

How to store cryptocurrency securely

Risks and benefits of investing in cryptocurrency

Related collections

Similar ideas to 6 ideal investments for beginners

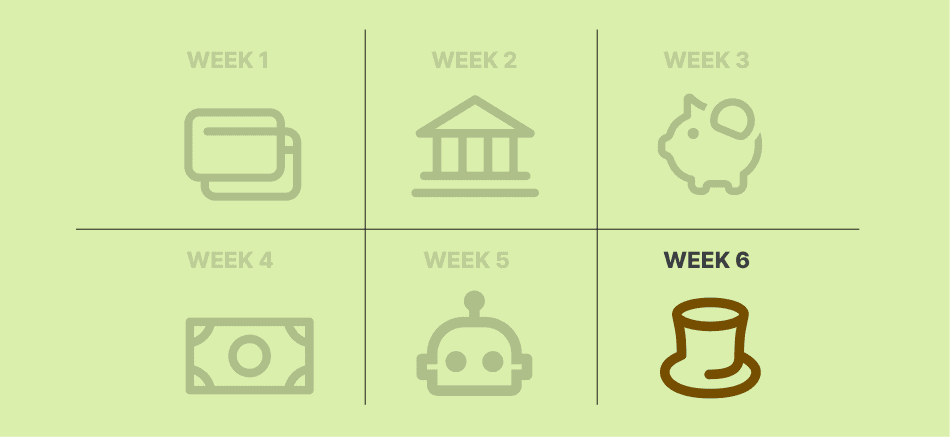

Week 6: Start Investing

Invest in index funds not individual stocks. Put your own behavioral psychology to work here. Invest automatically and over long periods of time.

Once you’ve covered the basics (aka index funds), allocate 5-7% of your income to “mental outlets.” This is money for you to inv...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates