Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

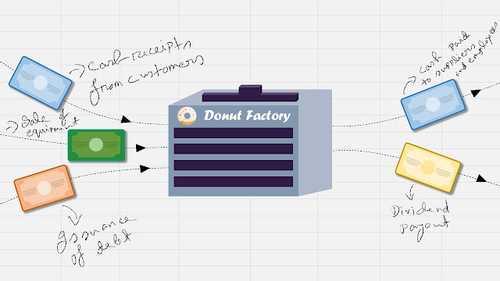

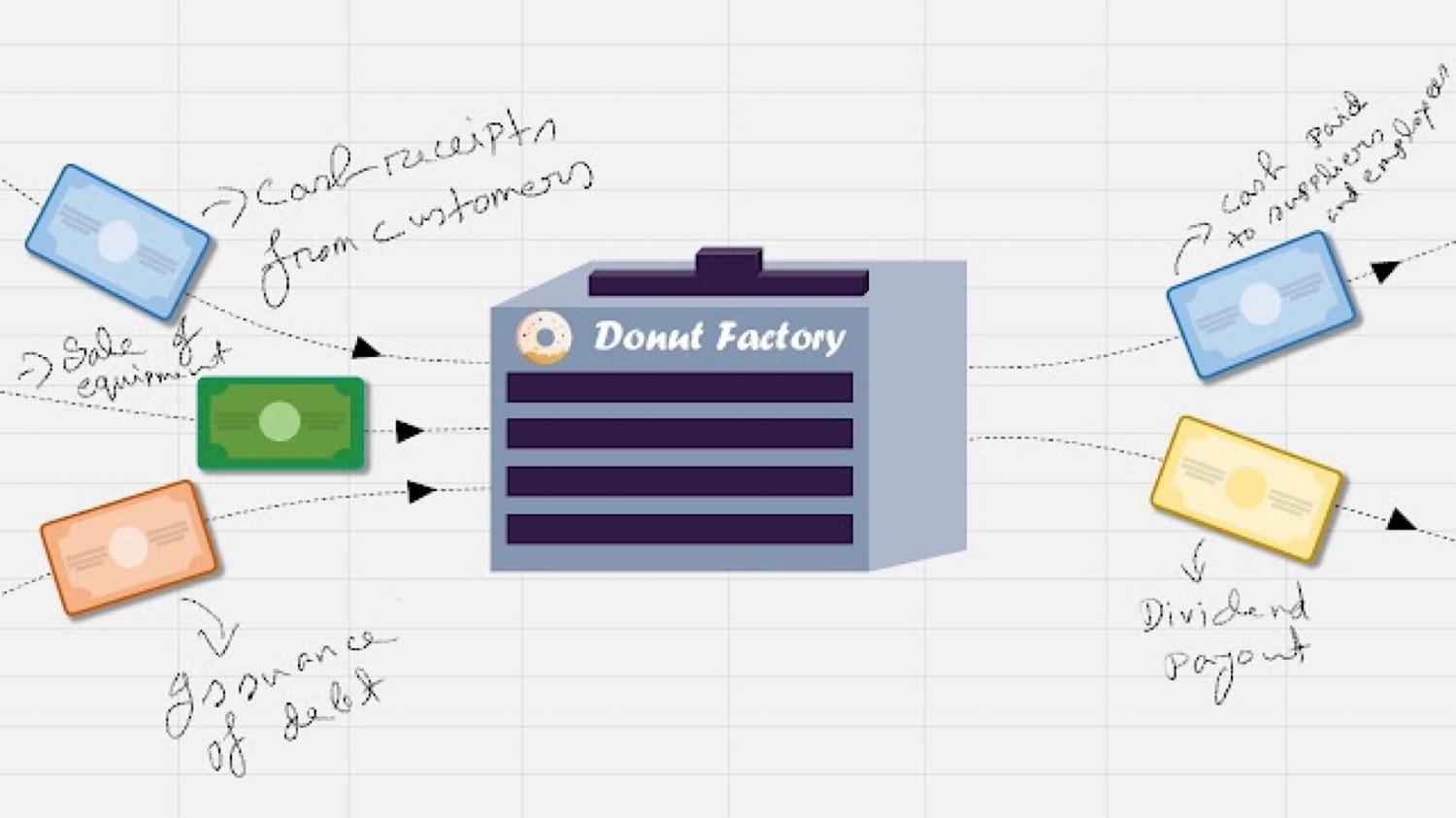

What Is Cash Flow Statement?

Cash flow statement demonstrates the flow of cash coming into a business and going out from a business through operating activities, investing activities and financing activities. Unlike income statement it doesn’t record any transaction that doesn’t involve cash like sale on credit.

3

33 reads

Operating Activities

Operating activities record cash transactions related to the daily operation like cash payment to suppliers, employees and cash receipt from customers.

3

10 reads

Investing Activities

Investing activities record purchasing and selling of long term assets and other investments including purchase of property, plant, equipment, invest in intangible assets, acquisition of another company, investment in equity and debt securities etc.

3

5 reads

Financing Activities

Financing activities include obtaining or repaying capital from or to shareholders and creditors. A company can obtain capital from issuing common stock, right shares or debt instruments like bonds. These items are recorded in this segment. Cash outflows include cash payments to repurchase stock (e.g., treasury stock) and to repay bonds and other borrowings.

3

17 reads

IDEAS CURATED BY

Md. Nazmus Sakib's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to create and sell NFTs

The future of NFTs

The benefits and drawbacks of NFTs

Related collections

Similar ideas

10 ideas

Here's What Buyers Look for in SaaS Businesses

baremetrics.com

6 ideas

The Main Focus Points When Analyzing a Balance Sheet

investopedia.com

6 ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates