Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

The Characteristics of The Intelligent Investor

- Patient

- Disciplined

- Keen to learning new things

- Able to keep emotions in check

- Able to think for themselves (critical thinking skills)

954

10.5K reads

What Consists Intelligent Investing

- Intelligent investing requires a thorough analysis of the company's (that you'll be investing in) fundamentals

- Includes the competency to protect himself from or against severe losses

- An intelligent investor must not anticipate extraordinary results therefore keeping expectations low but still aim for an adequate performance

834

6.89K reads

“People who invest make money for themselves; people who speculate make money for their brokers.

BENJAMIN GRAHAM

845

7.64K reads

The Intelligent Investor vs The Speculator

The investor believes that the market price is judged based on the established standards of value, while the speculator bases all their judgment on market price.

To distinguish whether you are the intelligent investor or a speculator, ask yourself whether or not you would invest in a stock without seeing its chart.

Additionally, the intelligent investor is not looking for quick gains but rather something long-term and sustainable regardless of the market's volatility.

838

5.06K reads

The stock investor is neither right or wrong because others agreed or disagreed with him; he is right because his facts and analysis are right.

BENJAMIN GRAHAM

799

6.51K reads

The Rule of Opposite

Benjamin Graham stated that the more enthusiastic investors and speculators become in the long run (of investing), the more certain they are to be proved wrong in the short run because the future of the market is unpredictable.

To be an intelligent investor means to be humble, composed, and that they should be abe to expect the unexpected.

813

4.6K reads

Types of Investors

In Benjamin Graham's book, he defines two types of investors based on the aggressiveness of their portfolios:

- The active / enterprising investor; and

- The passive / defensive investor

The former requires continuous researching of stocks, bonds, and mutual funds and this type of investor exerts much time and energy, while the latter has a fixed portfolio that runs autonomously regardless of the situation.

If you plan to become an investor, pick the type that best suits your personality to ensure the longevity of the approach.

829

3.78K reads

For the Defensive Investor

Once you have your capital, invest 50% of it into bonds or an index fund (depending on market conditions) while the other 50% to be invested on individual stocks.

However, when investing on individual stocks make sure of the ff:

- avoid small cap stocks unless they're diversified

- current assets should at least double current liabilities

- stock earnings show stability over the previous 10 years

- look for companies that have a history of paying dividends

- PE (price earnings) ratio must be no more than 15 over the previous 3 years; and

- if their book ratio is less than 22.5, it's reasonably priced

1.07K

3.86K reads

For the Enterprising Investor

Before investing your capital:

- make sure that their current ratio is below 1.5

- debt must be no more than 110% of working capital

- current earnings per share must be greater than their earnings per share (EPS) from 5 years ago

- they must pay a current dividend regardless of the amount

- their price to book must be less than 1.2; and

- the PE (price earnings) ration must be less than 10

981

3.4K reads

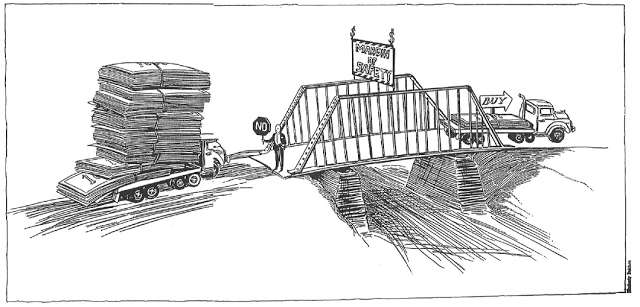

Margin of Safety

This is a principle of investing wherein an investor purchases securities only when their market price is significantly below their intrinsic value.

The formula to determine the intrinsic value of something is:

Margin of Safety = Market Cap / Deep Value Bargain Investing

Remember, the market swings wildly from day to day and presents large changes in valuation over periods of euphoria and pessimism.

870

3.53K reads

IDEAS CURATED BY

Juliana L.'s ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to create a diversified portfolio

How to analyze stocks and bonds

Understanding the basics of investing

Related collections

Different Perspectives Curated by Others from The Intelligent Investor, Rev. Ed

Curious about different takes? Check out our book page to explore multiple unique summaries written by Deepstash curators:

5 ideas

Sanyasi @@'s Key Ideas from The Intelligent Investor

Benjamin Graham

1 idea

's Key Ideas from The Intelligent Investor

Benjamin Graham, Warren E. Buffett, Jason Zweig

5 ideas

Discover Key Ideas from Books on Similar Topics

3 ideas

EBITDA is Bullsh*t

Long Term Mindset

14 ideas

Good Strategy Bad Strategy

Richard Rumelt

135 ideas

One Up On Wall Street

Peter Lynch, John Rothchild

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates