The "zero-sum budget"

An emergency savings fund buffer is vital for freelancers. It will help you to keep your head above water when your income fluctuates.

A zero-sum budget means living off last month's income alone. This can be done in the following way:

- Start building a budget by assigning every dollar to a particular monthly expense.

- Write down your bills, including rent and insurance.

- Make a list of any debt payments and savings goals, and assign dollar amounts to each. As your income fluctuates, so will the dollars assigned to savings and debt repayment.

9

75 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

The differences between Web 2.0 and Web 3.0

The future of the internet

Understanding the potential of Web 3.0

Related collections

Similar ideas to The "zero-sum budget"

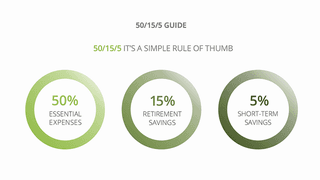

The 50/15/5 rule for multiple financial goals

- 50% of your income goes toward essential expenses: rent, bills, minimum debt payments.

- 15% percent goes to retirement savings. They also suggest you increase this by 1% each year.

- 5% goes toward unexpected monthly expenses or building an emergency...

Building a budget

- The traditional budget starts with tracking expenses, getting rid of debt, and then building an emergency fund.

- But you can speed up the process by building a partial emergency fund. It will act as a buffer to replace the use of a credit card for e...

The zero-sum budget

Using this method forces you to “spend” every dollar that you make, by allocating all of your earnings into the different categories that your finances require.

It prevents waste and maximizes your income, with the ultimate goal of reaching zero at the end of each month.

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates