Building a budget

- The traditional budget starts with tracking expenses, getting rid of debt, and then building an emergency fund.

- But you can speed up the process by building a partial emergency fund. It will act as a buffer to replace the use of a credit card for emergencies.

- An emergency fund is used to prevent you from having to use your credit card for unexpected expenses.

- Once this buffer is in place, its time to eliminate or substitute unnecessary expenses. Instead of buying coffee from a coffee shop every day, invest in a coffee maker, and save more money long term.

- When you have completed downsizing, then only find new sources of income. This way, your added income will not be wasted.

- It is better to have no debt before you begin investing.

134

488 reads

CURATED FROM

IDEAS CURATED BY

"Making money is art and working is art and good business is the best art." ~ Andy Warhol

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to use storytelling to connect with others

The psychology behind storytelling

How to craft compelling stories

Related collections

Similar ideas to Building a budget

Things To Do Before Focusing On Building Wealth

- Create a budget and stick to it

- Pay off your debt – especially high-interest credit card debt

- Learn how to save money to cover unplanned expenses

- After establishing an emergency fund and becoming debt-free, go all-in on building wealth!

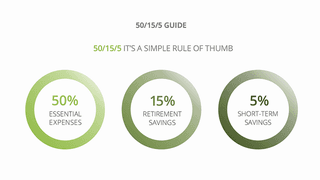

The 50/15/5 rule for multiple financial goals

- 50% of your income goes toward essential expenses: rent, bills, minimum debt payments.

- 15% percent goes to retirement savings. They also suggest you increase this by 1% each year.

- 5% goes toward unexpected monthly expenses or building an emergency...

The "zero-sum budget"

An emergency savings fund buffer is vital for freelancers. It will help you to keep your head above water when your income fluctuates.

A zero-sum budget means living off last month's income alone. This can be done in the following way:

- Start

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates