The Uncertain Future

Long-term planning is harder than it seems because people’s goals and desires change over time.

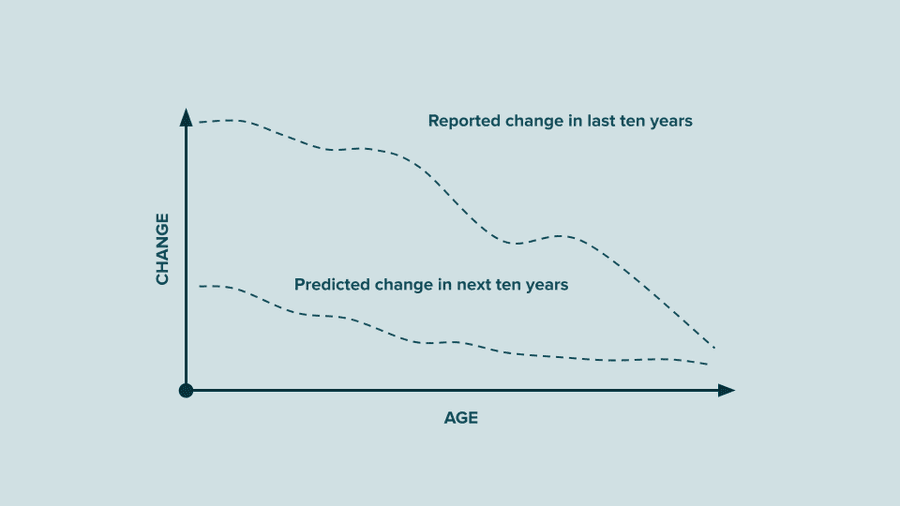

We’re such poor forecasters of our future selves that there’s a term for this phenomenon: The End of History Illusion. We’re aware of how much we’ve changed in the past, but we grossly underestimate how much our personalities, desires, and goal will change in the future.

You can’t prepare for what you can’t envision.

6.43K

12.2K reads

CURATED FROM

IDEAS CURATED BY

Total food specialist. Friendly webaholic. Coffee fan. Proud analyst. Tv expert. Explorer. Travel nerd. Incurable beer advocate.

The Psychology of Money is a collection of short stories exploring the strange ways people think about money and teaches you how to make better sense of it.

“

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to develop a healthy relationship with money

How to create a budget

The impact of emotions on financial decisions

Related collections

Similar ideas to The Uncertain Future

End Of History Illusion

The tendency for people to be keenly aware of how much they've changed in the past, but to underestimate how much their personalities, desires, and goals are likely to change in the future.

The end-of-history illusion

The end-of-history illusion is when we underestimate how much our personalities, work situations and values will change in the future.

The end-of-history illusion was coined in 2013. It is based on a series of studies showing that people tend to think that they will change...

The Problem with Imagination

We have very little idea about just what situations we will find ourselves in. Our imagination is also influenced by films and Tv.

When we make these grand decisions, we use imagination three times- we imagine what we imagine to be our future selves in imagined alternative scenarios.

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates