Your investment time-frame

Decide for how long you want to invest to best evaluate your portfolio for the future.

A short term investment portfolio will likely be riskier than long term retirement portfolios.

97

819 reads

CURATED FROM

IDEAS CURATED BY

"Many people are in the dark when it comes to money, and I'm going to turn on the lights. " ~ Suze Orman

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to manage risk

How to analyze investment opportunities

The importance of long-term planning

Related collections

Similar ideas to Your investment time-frame

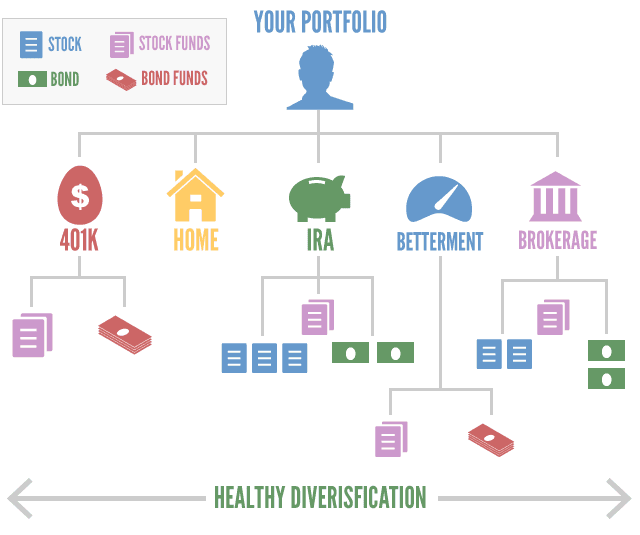

Portfolio and Diversification

- Your portfolio reflects your long-term wealth building investment strategy – not the short term. It includes everything you own. Your retirement accounts, your investment accounts, even your home are types of investments.

- Diversification is a way to describe owning mult...

The happiness portfolio

Happiness can be thought of as a retirement portfolio. You want it balanced with short and long term investments.

Those in pursuit of purpose miss that there is value in the sum of positive emotions we experience every day. If you're only goal-oriented, you forgo today's ...

Golden rules of investment

There are a few things to remember before investing in stocks:

- First, it's important to have a clear understanding of what you're buying. Make sure you know the company's financial situation and what the stock is worth.

- Second, don't invest too much money in one stock. It's imp...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates