Typical Budgeting is Flawed

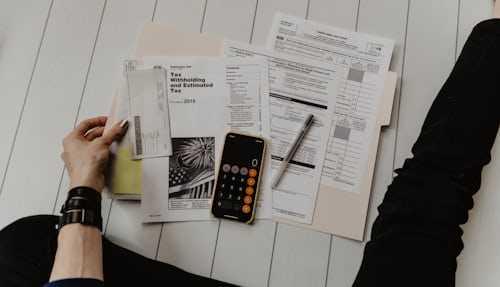

Typical regular budgeting methods assume that just by allotting limited money to a particular expense type (like groceries) is enough for us to spend less and balance our budget instantly.

This suddenly asks us to curb our lifestyle by focusing on everything at once, instead of a step-by-step approach. We normally fail at this 'ideal' method and need a realistic way to deal with our budget.

114

1.48K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to make sustainable choices in everyday life

Identifying ways to reduce waste and conserve resources

Understanding the impact of human actions on the environment

Related collections

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates