Bottom Line

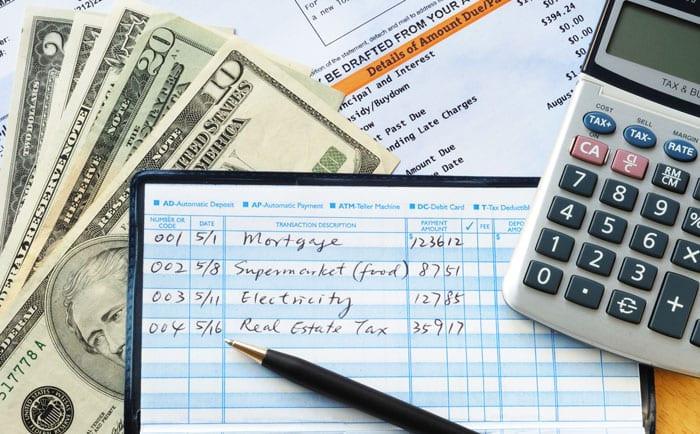

Saving is difficult, and life often throws unexpected expenses at us. By following the 50-20-30 rule, individuals have a plan with how they should manage their income.

Your savings and wants can be different depending on your own situation and what you want to achieve financially.

3

6 reads

CURATED FROM

IDEAS CURATED BY

Finance management is important, without which we will always struggle no matter how much money we make.

“

Similar ideas to Bottom Line

The 50:30:20 budgeting method

Under this method, 50 percent goes to expenses, 30 percent goes to wants, and 20 percent goes to a combination of debt and savings.

A person with a healthy amount of disposable income but loads of debt could probably benefit more from the 50:30:20 method.

Learn to Budget

Create a plan for your money so you know where it's going every month.

A popular and effective way to budget is with the 50/30/20 rule, where 50% of your income goes towards necessities (bills, food, housing, etc.), 20% of your income goes towards savings a...

How much you should save every month

The popular 50/30/20 rule states that you should reserve 50 percent of your budget for essentials like rent and food, 30 percent for discretionary spending, and 20 percent for savings.

But it's not that simple. If you're a high earner, you'd be wise to save a larger percentage of your inco...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates