How much you should save every month

The popular 50/30/20 rule states that you should reserve 50 percent of your budget for essentials like rent and food, 30 percent for discretionary spending, and 20 percent for savings.

But it's not that simple. If you're a high earner, you'd be wise to save a larger percentage of your income. If 20 percent is impossible for you to save, then saving something is better than saving nothing.

997

7.56K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

Identifying the skills needed for the future

Developing a growth mindset

Creating a culture of continuous learning

Related collections

Similar ideas to How much you should save every month

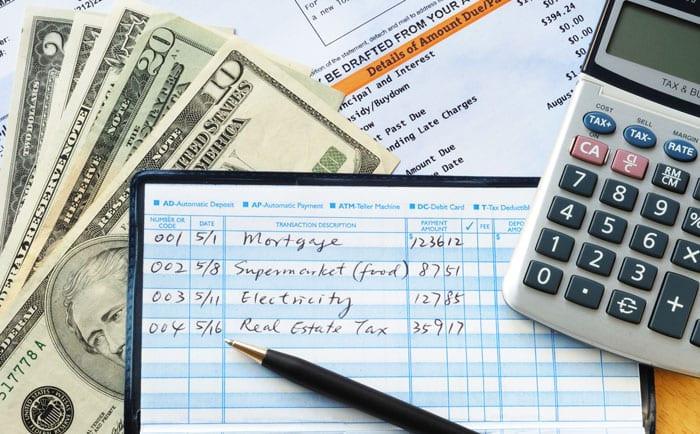

Learn to Budget

Create a plan for your money so you know where it's going every month.

A popular and effective way to budget is with the 50/30/20 rule, where 50% of your income goes towards necessities (bills, food, housing, etc.), 20% of your income goes towards savings a...

When you can't save that much

If you cant save 20 percent, you are not a failure. While everyone should aim for 20 percent, not everyone will hit the target on their first try.

Start small. Start with 1 percent. Slowly increase. Aim for higher, but if it leaves you stressed, scale back. However, keep t...

Budgeting your money is the cornerstone of a sound financial plan, and seeing all the numbers in black and white can offer valuable perspective on where your mone...

WES MOSS

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates