2- Margin of Safety:

Graham emphasizes the idea of a "margin of safety" - the difference between the intrinsic value of a stock and its market price. This principle is designed to protect investors from unforeseen market downturns.

16

154 reads

CURATED FROM

IDEAS CURATED BY

Being an ambivert person, I am too much fond of reading, and always eager to learn.

In essence, the ideas from "The Intelligent Investor" offer a holistic framework for making well-informed, rational decisions, managing risk, and pursuing long-term growth. These principles extend beyond the realm of investing and are valuable tools for navigating life's challenges and opportunities with prudence and intelligence.

“

Similar ideas to 2- Margin of Safety:

What is Margin of Safety?

‘Margin of safety’ is the difference between a stock price and its intrinsic worth, or value.

So if a stock is trading at $70 in the market, and you calculate the company’s intrinsic value as $100, you have a margin of safety of $30 (100 minus 70). In other terms, the sto...

Margin of Safety

This is a principle of investing wherein an investor purchases securities only when their market price is significantly below their intrinsic value.

The formula to determine the intrinsic value of something is:

Margin of Safety = Market Cap / Deep Value Barg...

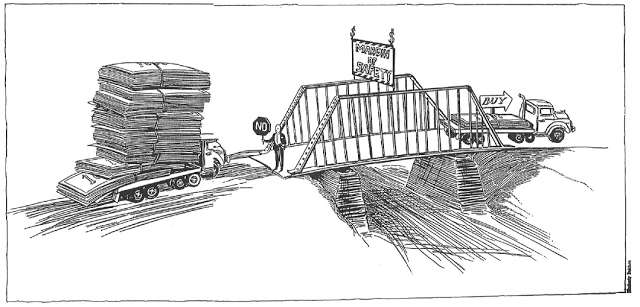

Have Margin of Safety

Things don’t always go as planned. You need to have a buffer between what we expect to happen and what could happen. That’s margin of safety.

Engineers build a bridge to sustain more than double its maximum capacity. Investors only choose business they understand so that they can calculate ...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates