Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Navigating the Market with Intelligence: Main Lessons from "The Intelligent Investor"

The Intelligent Investor" by Benjamin Graham is a timeless classic in the realm of investment philosophy.

Here are the 7 points from the book

13

202 reads

1- Value Investing:

The book introduces the concept of value investing, emphasizing the importance of purchasing stocks at prices significantly below their intrinsic value. Graham's approach focuses on long-term growth and safety rather than short-term market fluctuations.

16

168 reads

2- Margin of Safety:

Graham emphasizes the idea of a "margin of safety" - the difference between the intrinsic value of a stock and its market price. This principle is designed to protect investors from unforeseen market downturns.

16

154 reads

3- Rational Investing:

Graham advocates for rational decision-making in investments, urging investors to base decisions on careful analysis rather than succumbing to emotional impulses.

16

153 reads

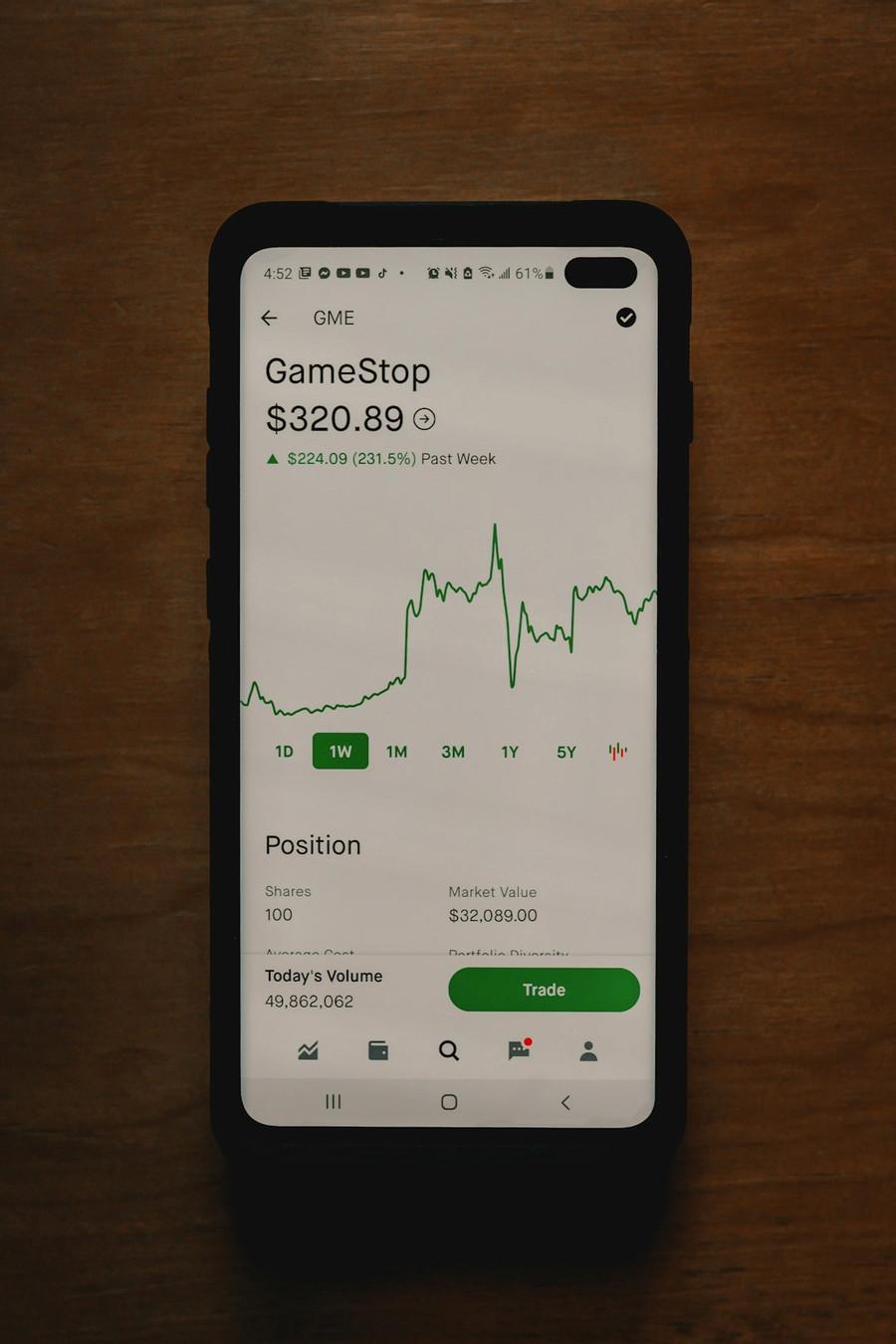

4- Market Fluctuations:

The book acknowledges the inevitable volatility of the stock market and advises investors to take advantage of market downturns by buying undervalued stocks.

15

137 reads

5- Diversification:

Graham suggests diversifying investments across different industries to mitigate risk. He emphasizes that diversification should not be taken to an extreme, but rather as a way to reduce the impact of a single loss.

16

119 reads

6- Importance of Research:

The book underscores the importance of thorough research before making investment decisions. Graham encourages investors to analyze financial statements, earnings, and other relevant data.

16

125 reads

7- Investor Psychology:

Graham delves into investor psychology, highlighting the impact of fear and greed on investment decisions. He suggests that investors should remain objective and avoid getting caught up in market sentiments.

15

130 reads

IDEAS CURATED BY

Being an ambivert person, I am too much fond of reading, and always eager to learn.

CURATOR'S NOTE

In essence, the ideas from "The Intelligent Investor" offer a holistic framework for making well-informed, rational decisions, managing risk, and pursuing long-term growth. These principles extend beyond the realm of investing and are valuable tools for navigating life's challenges and opportunities with prudence and intelligence.

“

Different Perspectives Curated by Others from The Intelligent Investor

Curious about different takes? Check out our book page to explore multiple unique summaries written by Deepstash curators:

5 ideas

Sanyasi @@'s Key Ideas from The Intelligent Investor

Benjamin Graham

1 idea

's Key Ideas from The Intelligent Investor

Benjamin Graham, Warren E. Buffett, Jason Zweig

5 ideas

Discover Key Ideas from Books on Similar Topics

8 ideas

Rich Dad's Guide to Investing

Robert T. Kiyosaki

5 ideas

12 ideas

Secret Millionaires Club

Andy Heyward

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates