Put Call Parity

Put-call parity is a fundamental relationship in european options pricing that states that the price of a put option, the price of a call option, the underlying asset price, and the strike price are all related. The formula for put-call parity is:

C + K = P + F

C is the price of the call option

K is the strike price of the option

P is the price of the put option

F is the price of the underlying asset

2

24 reads

CURATED FROM

IDEAS CURATED BY

Finance

“

Similar ideas to Put Call Parity

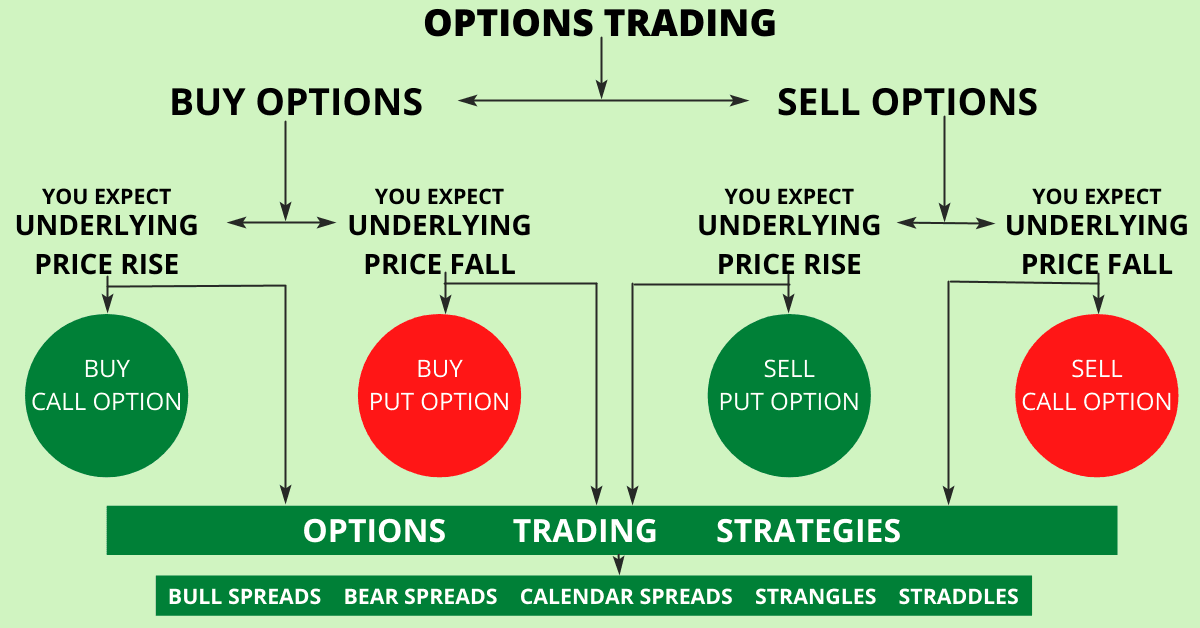

Forms of trading

Options are divided into "call" and "put" options. With a call option, the buyer of the contract purchases the right to buy the underlying asset in the future at a predetermined price, called

Covered Call

A covered call strategy involves buying 100 shares of the underlying asset and selling a call option against those shares. When the trader sells the call, the option's premium is collected, thus lowering the cost basis on the shares...

The Black-Scholes Theorem

This is a key concept in modern financial theory used for valuing European options and employee stock options.

Investors can use an online options calculator to get results by adding an option's strike price, the underlying stock's price, the option's time to expiration, i...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates