Applying Parkinson's Law to Personal Finance

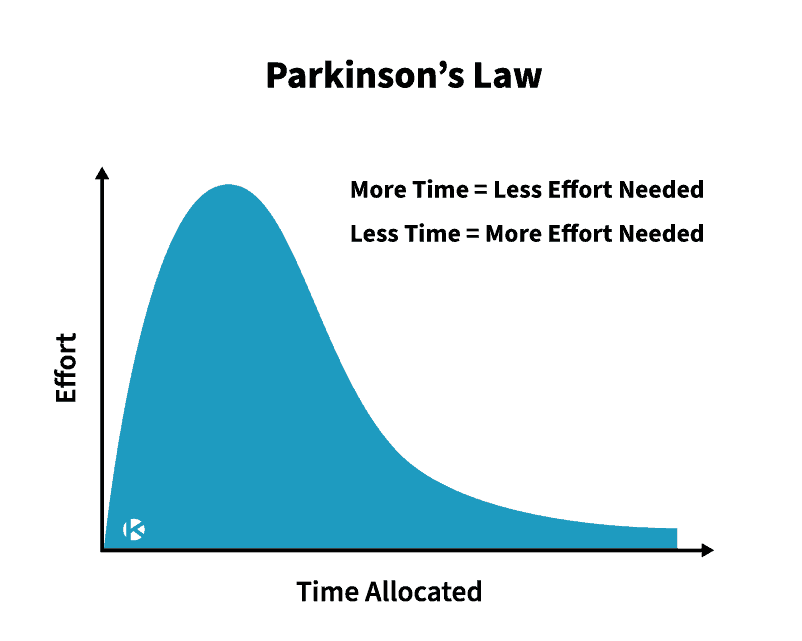

Parkinson's Law, originally related to time management, states that "work expands to fill the time available for its completion." When applied to personal finance, this principle suggests that expenses will always rise to meet income. In other words, as your income increases, so too will your spending, unless you consciously control it.

To apply Parkinson's Law , it’s crucial to set strict budgets and savings goals.By understanding and utilizing Parkinson's Law in your financial planning, you can avoid lifestyle inflation, where increased income leads to proportional increases in spending

33

381 reads

CURATED FROM

IDEAS CURATED BY

I believe that the vastness of the internet holds content that can aid each of you on your path to self-improvement. My hope is to curate and deliver this content to you, supporting your journey towards becoming a better version of yourself!

I think it's not always obvious how we are supposed to improve our finances, but I believe this video could provide some interesting insights!

“

Similar ideas to Applying Parkinson's Law to Personal Finance

Parkinson's Law

When working from home, have you ever felt like you couldn't do anything after lunch because you know you have the time to work on it later at night?

This phenomenon is called Parkinson's law where work expands so as to fill the time available for its completion. It basically mean...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates