Risk Assessment

Investors often use a combination of both types of analysis to make investment decisions. For example, fundamental analysis may identify a company with strong financials & growth potential, while technical analysis may be used to identify the best time to buy or sell the stock.

Another aspect of security analysis is risk assessment. Investors must assess the risk associated with a particular security before investing. This involves analyzing factors such as the company's debt levels, competition, and regulatory environment to determine the potential risks associated with investing in security.

191

310 reads

CURATED FROM

IDEAS CURATED BY

This Book by Benjamin Graham is a classic investment guide that provides timeless wisdom on value investing. It emphasizes the importance of a long-term approach to investing, patience, and discipline. The book teaches readers how to make smart investment decisions based on fundamental analysis and how to protect against the impact of inflation. It also provides practical advice on portfolio management, diversification, and risk management. The book discusses different investment strategies, including the defensive and enterprising investor approaches.

“

Similar ideas to Risk Assessment

Managing Risk Like NASA

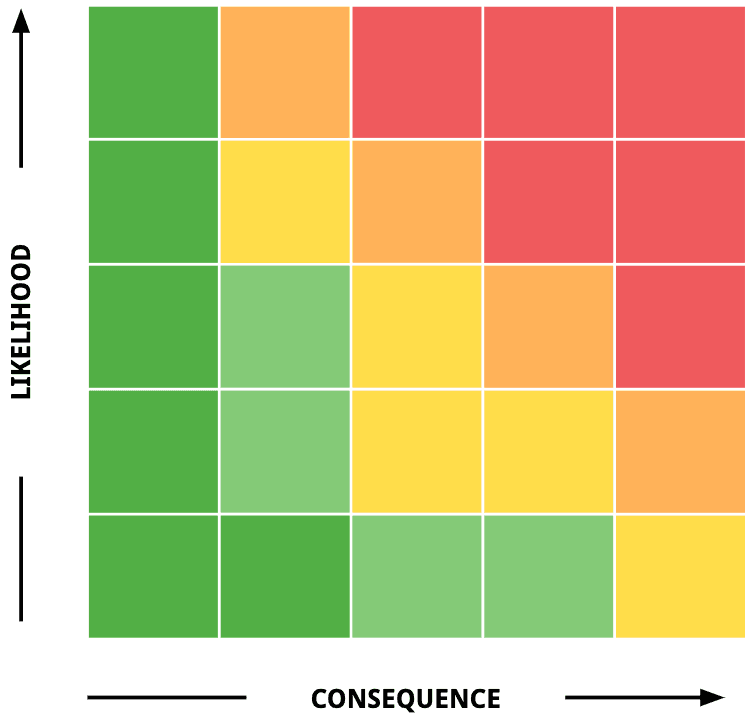

NASA is routinely dealing with problems that are as complex as they can get. Apart from having a process about measuring creativity, or a detailed checklist to take stock of every minute detail, they also have a Risk Matrix, a powerful tool that helps to identify and manage risk.

...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates