Assets vs. Liabilities 📊

The core lesson is simple but profound: buy assets, not liabilities. Kiyosaki defines assets as investments that generate income, like real estate or stocks, while liabilities drain your finances. This concept is the cornerstone of financial independence.

154

980 reads

CURATED FROM

IDEAS CURATED BY

Passionate about personal growth, financial literacy, and business strategy. Exploring ways to build wealth, develop effective habits, and scale businesses. Let’s connect and share insights on self-improvement and financial success! 💼📚💡

Rich Dad Poor Dad shifts perspectives on money, showing how to leverage assets, financial education, and a wealth mindset to achieve financial freedom. Through Kiyosaki’s guidance, readers learn to build wealth sustainably, transforming money into a powerful tool for lasting success.

“

Similar ideas to Assets vs. Liabilities 📊

Assets vs. Liabilities:

Kiyosaki introduces the concept of assets and liabilities, emphasizing the significance of building assets (such as real estate, stocks, and businesses) that generate income, rather than accumulating liabilities (such as consumer debt and luxury items).

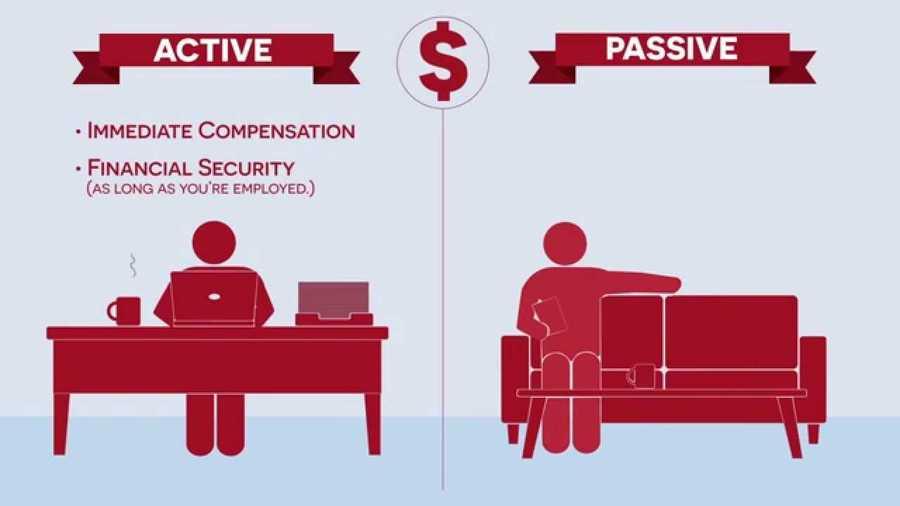

Active vs Passive Income

There are 2 types of income:

Active Income: You are trading time for money. In order to make money you must perform something. Every day you start from zero.

Passive Income: You do not have to be present to generate income. Things like real estate...

Risk is a spectrum

- The difference between investing or speculating, is not about what you buy, but why you buy—and that varies for people based on their financial goals.

- For example, a low-income earner near retirement won’t want to chase a short-term upswing. In cont...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates