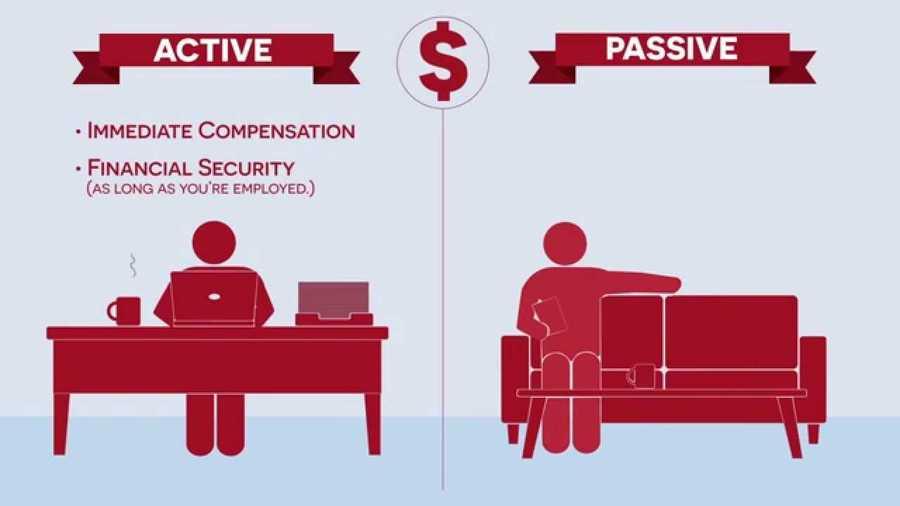

Active vs Passive Income

There are 2 types of income:

Active Income: You are trading time for money. In order to make money you must perform something. Every day you start from zero.

Passive Income: You do not have to be present to generate income. Things like real estate, stocks, bonds are sources of passive income. You are literally making money while sleeping.

320

2.02K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

Identifying the skills needed for the future

Developing a growth mindset

Creating a culture of continuous learning

Related collections

Similar ideas to Active vs Passive Income

Passive and Portfolio Income:

When my rich dad said, “The rich don’t work for money. They have their money work for them,” he was talking about passive income and portfolio income.

Passive incom...

The quest for passive income

The idea of a diversified portfolio is to have different kinds of active and passive income.

Passive income is investing time and money up front to help earn money continually even while you sleep. It can take many forms, including digital downloads, e-books, selling stock imagery, lic...

Active vs Passive Investing

Active investing strategies means picking your own stocks and building and managing a portfolio. It's hard and few people do it well.

Passive investing strategies mean investing in an index. When indexing, most people like to invest the same dollar amount ...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates