7. Master Finances

- Save 10%-20% of your income and invest wisely.

- Avoid debt and focus on long-term financial goals.

- Understand the value of delayed gratification when managing money.

237

1.84K reads

CURATED FROM

IDEAS CURATED BY

✍️Curious writer sharing big ideas ✨ in simple, quick reads 📚. Follow for more content! 🔥💡 💌 Support me on ko-fi

Imagine your life without excuses—how unstoppable would you be?

“

Similar ideas to 7. Master Finances

7. Create a Financial Plan

Develop a financial strategy that prioritizes long-term stability over short-term indulgences. Save and invest wisely to secure your financial future.

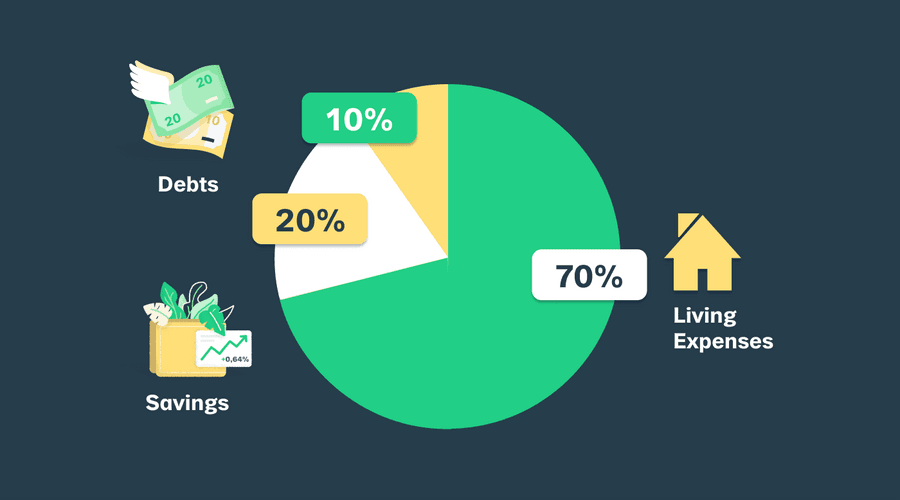

The 70:20:10 budgeting method

This method suggests that you allocate 70 percent of your income to expenses, 20 percent to savings, and the remaining 10 percent to debt.

70:20:10 may work for someone with a healthy emergency fund and minimal debt.

How long it will take you to save enough

How long it will take you to amass 25 times your income is based on the percentage of your income you save.

When you save 20 percent of your income, assuming a five percent average annual return, you'll hit 25 times your yearly income in just over 40 years.

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates