Long-Term (10+ years) Investing Strategy

After you maxed out your 401k, Roth IRA, and SEP-IRA, invest the rest in the following:

- 70% in index funds. They are low-tax since minimal trading is done within them.

- 20% in individual equities that you plan to hold for the long haul like Amazon, Apple, and Facebook. Invest in companies you use and believe in.

- 5% in physical real estate and REITs.

- 5% in non-traditional investments, like domains and art.

These percentages can fluctuate during the year, depending on the value of the individual equities. As you make more money, diversification becomes more important.

670

1.9K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to develop a healthy relationship with money

How to create a budget

The impact of emotions on financial decisions

Related collections

Similar ideas to Long-Term (10+ years) Investing Strategy

Taxes and investments

Three essentials for successful investing: Invest in things you understand with low fees and minimal taxes.

Taxes can take a massive chunk of your investments' future earnings, so minimize their impact as much as possible. With long-term ...

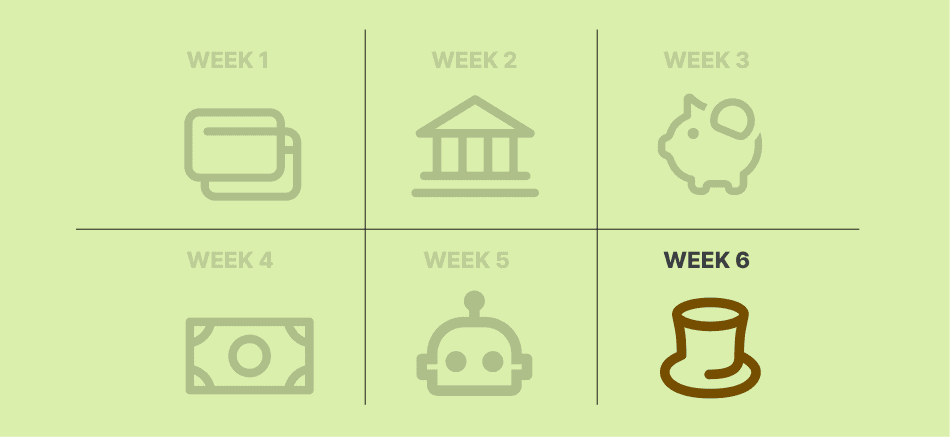

Week 6: Start Investing

Invest in index funds not individual stocks. Put your own behavioral psychology to work here. Invest automatically and over long periods of time.

Once you’ve covered the basics (aka index funds), allocate 5-7% of your income to “mental outlets.” This is money for you to inv...

Short-Term (1-5 years) Investing Strategy

For short-term investing, keep your money in a bond fund like the Vanguard Total Bond Market Index Fund or a certificate of deposit (DC) at your local bank.

If you are willing to take on a bit more risk, put your money in a balanced index fund like the Vanguard Wellesley Income Fund, which...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates