Deciding between the Snowball and Avalanche debt methods

The supporters of the two methods are both enthusiastic about which one to use. However, it barely matters which system you use. The best approach is the one that keeps you motivated.

Make the minimum payments on all of your debt. Then, focus on one debt that bothers you the most and put every dollar you can towards it until it is gone. Then move on to the next debt.

304

2.06K reads

CURATED FROM

IDEAS CURATED BY

Creator. Beer ninja. Travel lover. Twitter evangelist. Lifelong writer. Zombie expert.

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to build positive relationships with colleagues and superiors

How to navigate office politics without compromising your values

How to handle conflicts and difficult situations in the workplace

Related collections

Similar ideas to Deciding between the Snowball and Avalanche debt methods

How to deal with your debt

Try to transfer your debt onto a zero-interest credit card (also known as a balance-transfer card). It will give you a limited time window where your debt won't accrue interest and allow you to get rid of your debt faster. But ensure you can pay it off within that window, otherwi...

Takeaways from the 5 campaigns

- Make campaigns multi-platform

Start simple and work your way towards a more elaborate approach.

Try using Video Marketing to increase engagement and connect more to the people you are targeting.

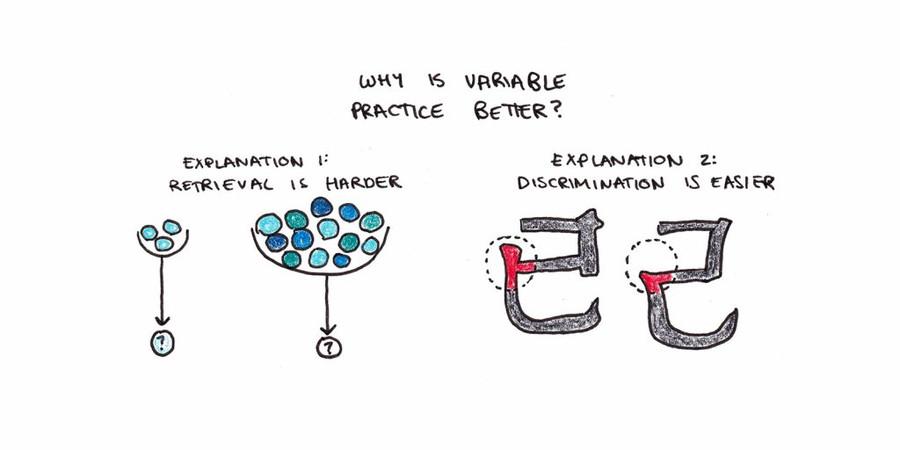

Mixing Concepts And Ideas

When you mix practice between two similar ideas or concepts, you’re better able to notice the difference between the two.

This discriminative account in favour of variable practice holds true for many problem-solving skills. Math problems are often taught in a blocked fashion. You learn so...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates