Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Gambling Verses Investing

The Bet That Proved Passive (Index) Investing is Superior to Active Management

26

585 reads

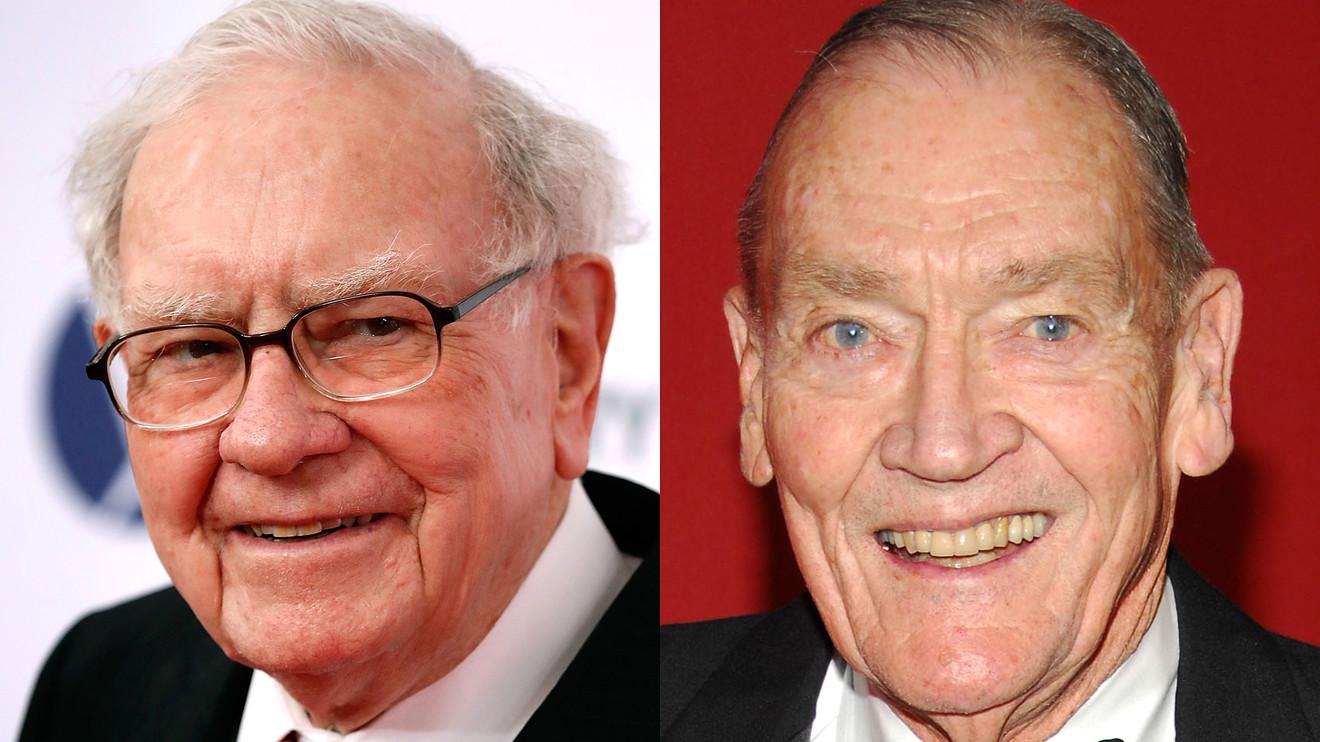

In a 2005 letter to the shareholders of his company wrote that active management professionals (hedge fund managers) not outperform individuals who used a passive (index) investing strategy over a ten-year period. To prove his sincerity in this belief he offered $500,000 (for charity) to anyone willing to accept his challenge.

25

404 reads

Warren Buffett pointed out that:

· Making money on the stock market; "Does not require great intelligence, a degree in economics or a familiarity with Wall Street jargon."

· "What investors then need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals."

· "Stick with big, 'easy' decisions and eschew activity.”

· Buffett also sought to make it loud and clear that he doesn't think the exorbitant fees that hedge funds charge are worth it.

27

260 reads

Bonds

Buffett acknowledged a lesson learned from an interesting plot twist over the course of the bet.

· At the outset of the wager, Buffett and Seides bought about $300,000 worth U.S. Treasury bonds, widely considered a safe investment.

· The expectation was that the bonds would grow to about $1 million at the end of the decade, and the winner would claim the prize pool for charity.

· But, the bonds gave back "pathetic" returns, Buffett wrote.

25

224 reads

Bonds Continued

· "Bonds had become a dumb -- a really dumb -- investment compared to American equities" or stock, he said.

· So, in 2012, Buffett and Seides dumped their Treasury bonds and used the money to buy B-class shares of Buffett's Berkshire Hathaway (BRKB).

· By the end of the bet, the Berkshire shares were worth $2,222,279 -- about $1.2 million more than they'd hope to earn with the bonds.

· In short, the "purportedly 'risk-free' long-term bonds" ended up being a "far riskier investment" than common stocks.

26

203 reads

John Clifton "Jack" Bogle (May 8, 1929 – January 16, 2019) was an American investor, business magnate, and philanthropist. He was the founder and chief executive of The Vanguard Group, and is credited with creating the first index fund. An avid investor and money manager himself, he preached investment over speculation, long-term patience over short-term action, and reducing broker fees as much as possible. The ideal investment vehicle for Bogle was a low-cost index fund held over a lifetime with dividends reinvested and purchased with dollar cost averaging.

26

182 reads

IDEAS CURATED BY

CURATOR'S NOTE

Attempting get rich schemes may very well lead to going broke quickly. Trying to get rich quick is gambling it is not investing.

“

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates