Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Golden rules of investment

There are a few things to remember before investing in stocks:

- First, it's important to have a clear understanding of what you're buying. Make sure you know the company's financial situation and what the stock is worth.

- Second, don't invest too much money in one stock. It's important to diversify your portfolio to minimize risk.

- Third, you will make money by waiting and not buying or selling.

- Finally, don't get too caught up in the short-term movements of the stock market. Focus on the long-term potential of your investments.

32

444 reads

Enter the stock market with a clear goal

When it comes to investing in stocks, there are a few key things to keep in mind. First and foremost, it’s important to do your research and understand the market you’re entering. It’s also crucial to have a clear financial goal in mind and to be aware of the risks involved.

27

356 reads

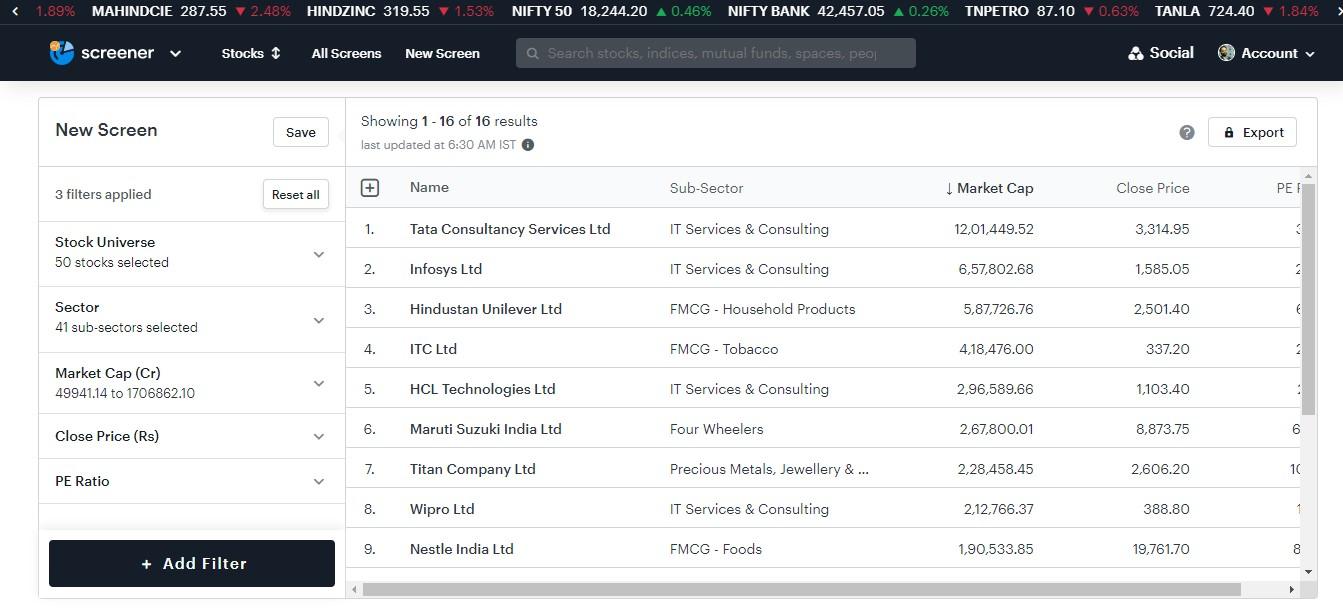

Filtration of stocks using a screener

- Using a screener website, filter the stocks based on the following criteria:

- Avoid loss-making companies.

- Avoid companies with high debt (ideally go for companies with no debt)

- Avoid companies with low capitalization (Less than INR 100 crore or USD 500 million).

- Avoid companies entering into emerging new sectors like web3 and blockchain.

41

377 reads

Selection of stocks

- Find an industry that has good growth potential. Then, find the leader and the challenger company in that industry. For example, in the tech industry, it will be Apple & Alphabet.

- Consider a company in an industry that is slowly changing. For example, P&G (an FMCG company) will release new washing detergents even after five years. The chances of them going down are very less.

33

313 reads

Selection of stocks...contd

- Look for companies that take calculated risks. For example, Apple first introduced its iPhone then after 2 years introduced the iPad, and after 2 years introduced the Apple Watch. This shows that Apple didn't introduce all products at once and gambled on a low-risk strategy.

- Always make sure to calculate a company's fair value. Don't buy at a high price. Wait for a correction in the price before investing. Set an alert: every time the stock falls by 5%, you will invest X amount.

- Find a company that has a strong competitive advantage (it can be a patent, certain technology, networks, etc).

35

295 reads

Number of stocks in a portfolio

If you want optimum returns on your portfolio, you need to have a maximum of 3-4 stocks (with the ratio 40:30:30) but it will have a higher risk.

If you want good returns with little risk then you need to have 6-8 stocks.

But if you want to take a minimum risk and be satisfied with +2% higher than the index return then go for 10-15 stocks.

12

61 reads

IDEAS CURATED BY

CURATOR'S NOTE

Before you invest in the stock market, it's important to have a solid plan and be disciplined in your approach. By being disciplined, you'll be more likely to stick to your plan and make smart investment choices. Here are a few tips to help you get started:

“

Similar ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates