Union Budget 2023-24: Focus on Inclusive Development, Environmental Consciousness, and Tax Reforms

Curated from: addingvalues.xyz

Ideas, facts & insights covering these topics:

18 ideas

·204 reads

2

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

UPI lead to Increase in Economy

The Indian economy has increased from 10th to 5th in the world. EPFO membership doubled to 27 crore and digital payments of 126 lakh crore rupees were made through UPI.

1

27 reads

Priority

Priority no 1 is inclusive development - covering farmers, women, youth, OBCs, divyang, etc. The sustained focus of Jammu & Kashmir, Ladakh and the North East.

1

20 reads

Agritech Startups

Financial support for agritech startups, cooperative-based economic model, enabling of massive decentralized storage capacity for farmers: Sitharaman.

1

18 reads

Education

Education - teachers' training to be re-envisioned through creative pedagogy. To build a culture of reading and make up for time lost during COVID-19, National Book Trust and Children Book Trust will be encouraged to provide non-curricular titles to physical libraries.

1

16 reads

Tribal Groups Development

15,000 crore for Primitive Vulnerable Tribal Groups Development Mission to improve socio-economic conditions of vulnerable tribal groups - safe housing, clean drinking water, access to education, etc.

1

11 reads

Support for poor prisoners

Support for poor prisoners - for those unable to afford the bail amount, required financial support will be provided.

1

10 reads

Railways get outlay

2.4 lakh crore outlay for Railways - 9 times the outlay made in 2013-14; 50 additional airports, velodromes, etc will be made for domestic travel

1

10 reads

Manual scavenging

Manual scavenging - 100 percent de-sludging of sewers to transition from manholes to machine hole mode. Focus on scientific management of dry and wet waste

1

10 reads

Compliances have been Reduced

More than 39,000 compliances have been reduced and 3,400 legal provisions have been decriminalized to further trust-based governance. Jan Vishwas Bill to amend 42 Central Acts

1

8 reads

India Promotes AI

Three Centres for Artificial Intelligence to be set up at top institutions. National Data Governance Policy to be launched to enable access to anonymized data.

1

9 reads

Voluntary Settlement scheme

Settling contractual disputes of govt agencies wherein the arbitral award is under challenge - a voluntary settlement scheme will be introduced. Graded settlement terms, depending on the pendency level of dispute.

1

8 reads

E-Courts project

Phase III of the e-courts project will be launched with an outlay of 7,000 crores

1

8 reads

Net zero carbon emissions by 2070

The movement towards an environmentally conscious lifestyle; aims for net zero carbon emissions by 2070. The focus is on green growth

1

11 reads

The Banking Regulation

Amendments to Banking Regulation Act, and RBI Act are being considered

1

6 reads

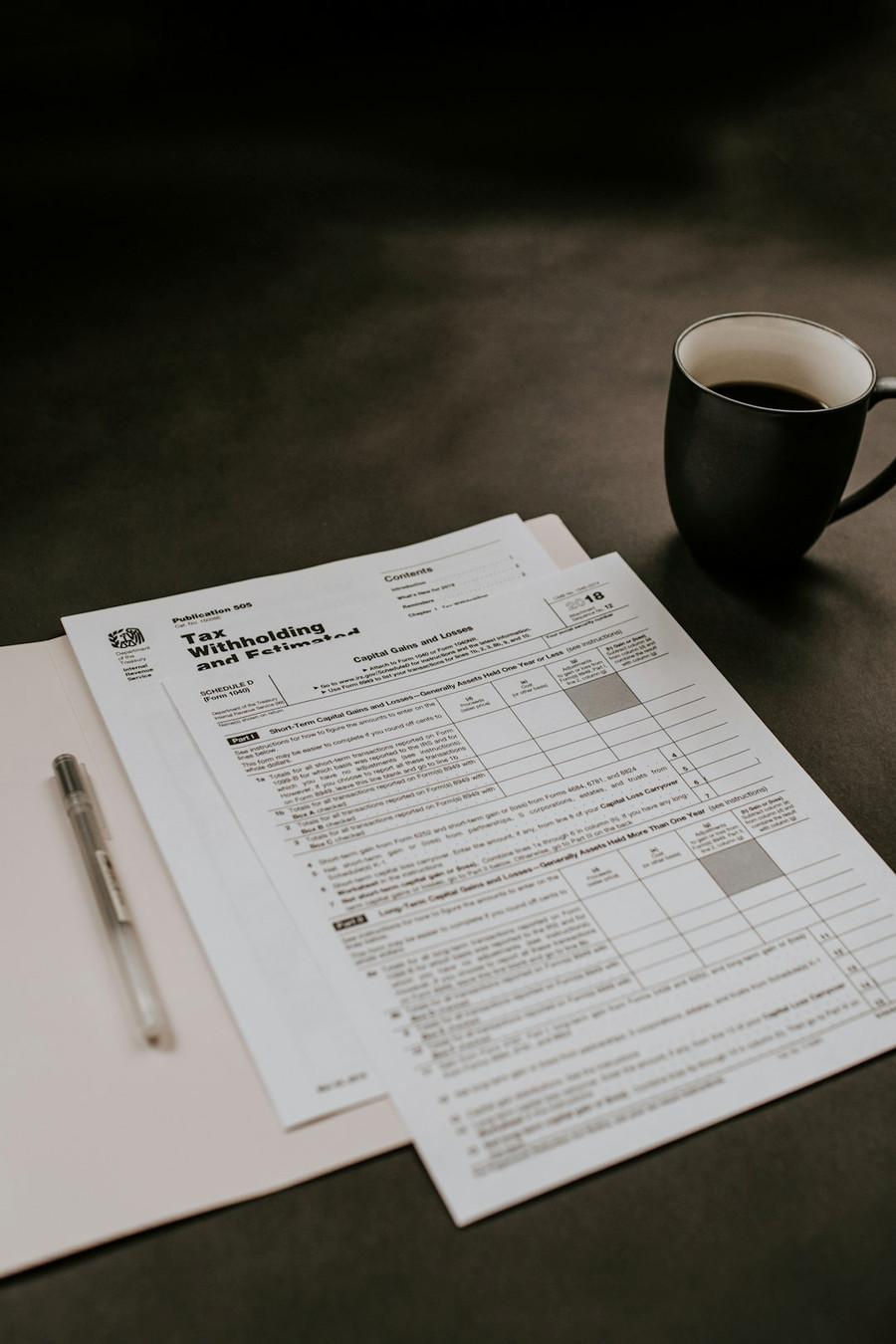

DIRECT TAX PROPOSALS AIMED AT REDUCING THE COMPLIANCE BURDEN

To reduce the pendency of tax appeals at the commissioner level, 100 joint commissioners are to be deployed for the disposal of small appeals. We shall also be selective in taking up cases for scrutiny of returns already received

1

7 reads

New tax rates:

0-3 lakhs - NIL

3-6 lakhs - 5 percent

6-9 lakhs - 1o percent

9-12 lakh - 15 percent

12-15 lakh - 20 percent

Above 15 lakh - 30 percent

1

8 reads

Conclusion

This was a Brief of Indian Budget 2023-24, If you wish to read the full Detield article then Click here to Read.

If you are inserted in getting this kind of Updates On Whatsapp Directly then Click here to Join 1Percent Club for FREE

Know more about 1Precent Club Here

ThankYou.

2

10 reads

IDEAS CURATED BY

Adding Values is a new innovative way to learn new things, you will get Brainstorming things at your Finger Tip. We are committed to giving Valuable knowledge to the People of the World.

CURATOR'S NOTE

A brief of Indian Budget 2023-24.

“

Adding Values's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

The importance of practice and repetition in learning

How to stay motivated and avoid burnout while learning

How to break down complex concepts into manageable parts

Related collections

Similar ideas

4 ideas

5 ideas

Your Complete Guide to Creating a Monthly Budget in 2020

listenmoneymatters.com

7 ideas

The Normal Economy Is Never Coming Back

foreignpolicy.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates