Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Part 1 Refresher : Ways To Grow Money

- Savings Accounts: High-yielding, Digital, Local FDIC insured

- Money Market

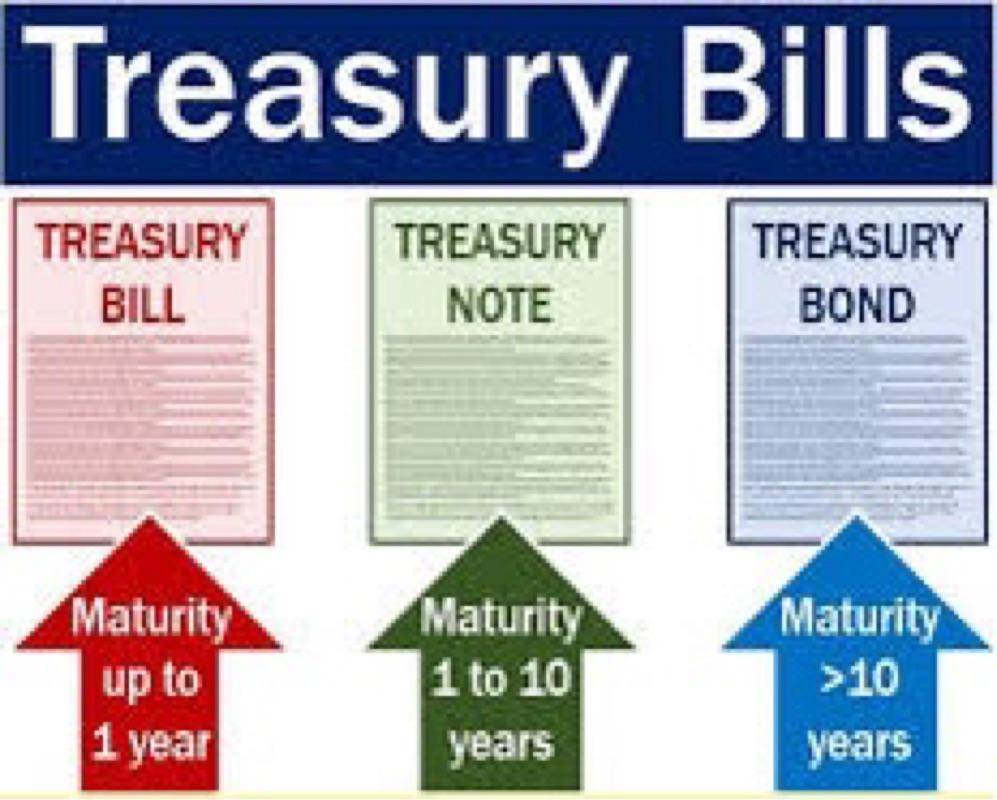

- Treasury Bills, T-Notes, T-Bonds

- Stocks

- Bonds

- Assets : Art, Jewelry, Old vehicle, Accounts Receivables, Machinery

- Gold/Silver

- Land

- Property

44

703 reads

Inflation Defined

A general increase in prices and fall in the purchasing value of money.

36

609 reads

How The Rich Get Richer During Inflation

- Assets gain value during inflation.

- Rich people have enough assets to create more wealth meanwhile, poor people don’t have any or enough assets.

- Poor people are consumers and utilize assets, but rarely own them. Ex: Renting homes, cars, properties.

- Wealthier people typically own a home that protects them from the rising rent caused by increasing prices.

38

533 reads

“During inflation, funds flow into the stock market, and stock prices continually rise. Money in those type of investments rise with inflation.”

FUN FACT

41

493 reads

The Harsh Reality

Rich people are earning more, yet doing less. However, poor people are spending more, which in return causes them to have to work more, and typically earn less.

39

476 reads

Solution

Diversify income. Be intentional to add more streams of portfolio and passive income than earned income. This is due to earned income requiring your actual time and having the highest tax.

41

441 reads

Treasury Bills Vs. Inflation

Treasury Bills have been coined the 'safest investment' on earth. One reason is because they are backed by the government, and there’s a quicker return that is guaranteed. They also have a quick maturity time, which is 1 year or less.

Con: You’re going to get a lower rate of return compared to other investments, such as stocks, bonds, money markets, and CD accounts.

42

394 reads

Treasury Notes

T-Notes are Short term intermediate term debt securities with maturities of 2, 3, 5, 7, or 10 years. Pay a fixed rate of interest every six months. Can be purchased directly from government at auction or through broker. Mature 2-5 years.

39

354 reads

Treasury Bills

T-bills are usually sold at a discount and sold in $100 increments. The interest is equal to the face value minus the purchase price. Rates depend on interest rate expectations. Can be purchased electronically.

38

362 reads

Treasury Bonds

T-bonds are fixed rate U.S government debt securities with a maturity of 20 or 30 years. Pays semiannually (every 6 months) until maturity, at which point the face value of the bond is paid to the owner.

37

315 reads

Interest Rates Effect

When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant, and yields go up. Conversely, when interest rates fall, prices of existing bonds tend to rise, their coupon remains constant - and yields go down.

37

315 reads

“Money is a tool, used properly it makes something beautiful. Used wrong it makes a mess.”

- BRADLEY VINSON

38

378 reads

What Are STCS ?

- STCs stand for Share certificates

- Fixed-rate term savings account

- Another way to save

- Issued only by credit unions, whereas CDs are only issued through banks

Pros:

- They are safe (low-risk), offer guaranteed returns, and are ideal for long-term savings.

- When you open a share certificate through a bank, you don't have to worry about losing your principal.

- Have higher interest rates than traditional savings accounts and are a safe place to keep your money.

Cons:

- May pay a penalty to access funds before the certificate matures, and there are better options for long-term investing.

Pros > Cons

3

6 reads

IDEAS CURATED BY

Smart girl with a big heart. I talk about finances, personal growth, and the real stuff. Let’s win! I ♥️ Humanity 🤝🏾🫱🏾🫲🏻🫱🏾🫲🏽🫱🏾🫲🏿 🌎

CURATOR'S NOTE

Want to know how the rich get richer during inflation? This read includes insight on the strategies and investments of the wealthy vs the impoverished. Lastly, learn a little about U.S. security debts and the benefits of inflation.

“

Similar ideas

9 ideas

12 ideas

Badass quotes from Video games pt. 2!

boredpanda.com

10 ideas

Impactful Quotes from TV Villains pt.2 (▀̿Ĺ̯▀̿ ̿)

magicalquote.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates