Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Defining a meaningful exit

Let’s start with some venture math assumptions:

- An early-stage venture fund is going to invest in 20 companies

- The fund aims to get a 3x gross return

- The expected distribution of outcomes is: 1/3 losses, 1/3 money-back, 1/3 successes

- The expected distribution of the successful outcomes is: 1 home-run (a company returning the entire fund) + 5 meaningful exits (companies returning the amount required up to 3x gross fund return.)

A meaningful exit can be defined as a company about to return 1/3 of the fund.

5

15 reads

Determining the Revenue Targets for Meaningful Exits

Before we can determine the revenue targets, again, we need some more assumptions:

- A SaaS company with 75% gross margin can be sold for 5x ARR

- A marketplace company with 15% take rate can be sold for 1x the last twelve months gross merchandise value

- An e-commerce company with 30% gross margin can be sold for 2x the LTM revenues

- In all cases, Net Debt at the time of exit equals zero, so Enterprise Value = Equity Value

- In all cases, the same growth rate is assumed

4

8 reads

Final Remarks

- Not every company can grow quickly enough to generate Venture-Scale returns. A VC should only invest in the companies with that potential.

- The fund size determines what a meaningful exit is.

- Some investors aim only at potential home-run exits. Others don’t. Both strategies have been proven successful over time.

- Use your gross margin and growth rate to determine the multiple you get in an exit.

- Compare the growth rates required to hit that target given your current level. Compare those rates to those of the most successful companies.

4

6 reads

Deriving the size of revenue by companies

The purpose of this post is to derive the size in terms of revenues that a company has to achieve in a 5–7 years time window to be regarded as attractive for VC investment. We will do that for different fund sizes (Micro $50Mm- $100Mm, traditional $350Mm and MEGA $1b VC funds) and different startup business models (Saas, Marketplaces, E-Commerce) this might also be helpful for the company and its investors to plan revenue targets and required growth rates for the years ..

4

3 reads

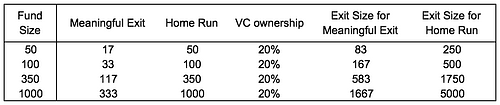

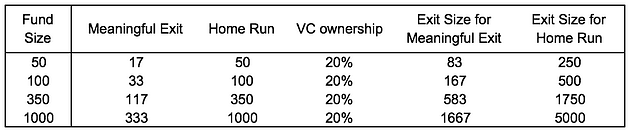

The size of a meaningful exit

The bigger the fund, the bigger the exit required to be considered meaningful.

Assuming that the VC is going to construct a 20% ownership in a successful company over time, we can calculate how much a company must be sold to be considered a meaningful exit.

4

4 reads

Attractive VC exits

The purpose is to help find the size in terms of revenues that a company has to reach in a 5-7 years time window to be considered attractive for VC investment.

This will be done for different fund sizes (micro, traditional and mega VC funds) and other startup business models (SaaS, marketplaces, e-commerce). This could also help the company and its investors to plan revenue targets and required growth rates from first investment to exit.

4

3 reads

IDEAS CURATED BY

Steven Allen's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to develop a healthy relationship with money

How to create a budget

The impact of emotions on financial decisions

Related collections

Similar ideas

10 ideas

The Startup Rules You Should Break If You Don’t Have VC Investors

entrepreneurshandbook.co

8 ideas

2 ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates