Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

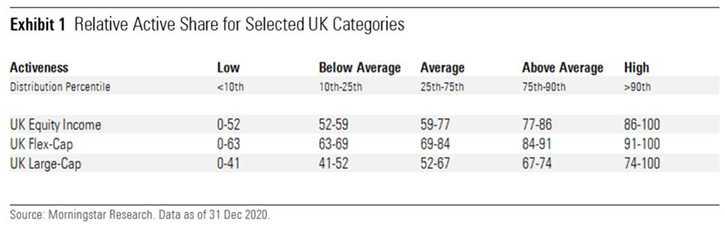

Active share is a measure of the difference between a portfolio and a benchmark. It’s an important concept for investors wishing to judge how fund managers’ portfolios deviate from the index, and how that affects performance. It can show clearly when a fund is a "closet index tracker", one that holds shares very similar to the index but charges fees associated with active management. (The higher the active share, the more the fund differs from the benchmark).

5

41 reads

Looking at active equity funds across the globe, some invest in narrow markets, such as Danish, Italian, or Singaporean equities, with highly concentrated benchmarks and only a short list of constituents. On the other hand, in global or regional categories, indexes hold a far longer list of names, with the largest stocks carrying lower weights than in narrow-market indexes. In a broadly diversified market like this, an active fund manager can deviate from the index much more easily, without excessively diverging in terms of style or market cap, than in a concentrated market.

5

12 reads

In the study, we took a broad look across Morningstar Categories to understand similarities and differences between their levels of active share. This allowed us to show just how different categories are in terms of their active-share profiles, confirming the intuition that top-heavy indexes represent a more difficult investment universe from which to build high-active-share portfolios, at least without taking meaningful off-benchmark positions. The number of securities in a benchmark also plays a role, but to a lesser extent than concentration.

5

8 reads

IDEAS CURATED BY

Decebal Dobrica's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

Understanding the basics of cryptocurrency

How to store cryptocurrency securely

Risks and benefits of investing in cryptocurrency

Related collections

Similar ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates