How Do Venture Capitalists Make Decisions?

Curated from: medium.com

Ideas, facts & insights covering these topics:

5 ideas

·869 reads

13

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

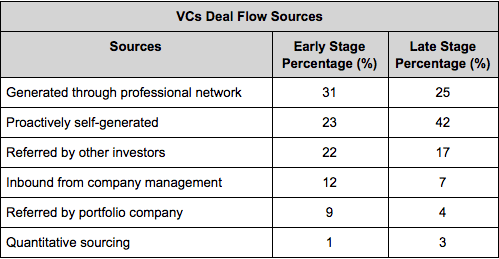

Deal Sourcing

Deal sourcing refers to the process by which VCs attract entrepreneurs and sort through those opportunities to make an investment decision.

18

315 reads

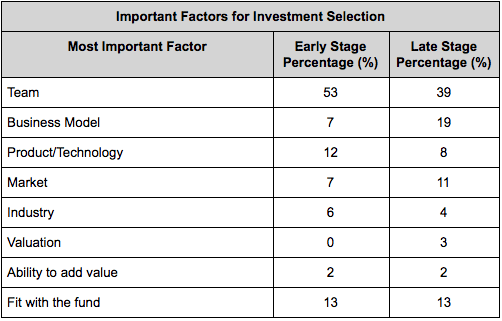

Investment Selection

When considering a deal, VCs will look at the attractiveness of the market, strategy, technology, product/service, customer adoption, competition, deal terms, and the quality and experience of the management team.

20

154 reads

Valuation Tools

Give the uncertainty of most of their investments, it is not surprising that most VCs don’t really use financial techniques such as DCFs or NPV to evaluate their investments.

Most commonly metrics used are cash-on-cash return, multiple of invested capital and net IRR. An other interesting finding is that fewer than 30% of companies meet projections.

20

168 reads

Deal Structure

VCs syndicate around 65% of their investments in an attempt to share risks, build reputation, reduce capital constraints and gain complimentary expertise.

The intended goals of VCs contracts are to make sure that the entrepreneur does well if he/she performs well while providing VCs with leverage if the entrepreneur does not perform. VCs achieve these objectives through cash flow rights, control rights, liquidation rights and employment terms.

18

103 reads

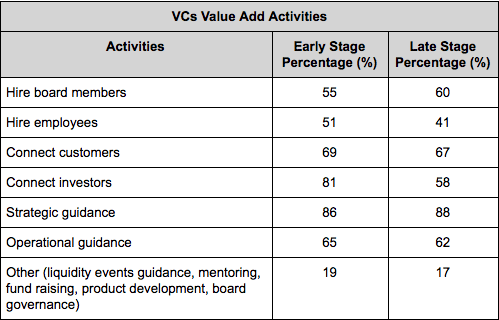

Post-Investment Value Add

VCs are active investors and strive to add value to their companies after they invest.

VCs are critical in the professionalization of startups: they will improve governance through strategic guidance, by structuring the boards of directors and by helping in hiring outside managers and directors.

16

129 reads

IDEAS CURATED BY

Gary Walker's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

Strategies for building self-confidence

Techniques for embracing your strengths and accomplishments

Tips for seeking support and feedback

Related collections

Similar ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates