2. Pay your bills on time, all the time

Your payment history is the biggest factor in determining your credit score. Lenders don't want to give money to someone who has a history of missed payments.

Paying a bill more than 30 days late can drag down your score. "One single missed payment can drop your score anywhere from 100 to 300 points," said McClary.

If you went through a period of time where money was tight and you were late with some payments, it's time to right the ship. Curb your spending and start a track record of paying your bills on time.

Here's the golden rule: Only charge what you can afford to pay every month in full.

27

58 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

Understanding the basics of cryptocurrency

How to store cryptocurrency securely

Risks and benefits of investing in cryptocurrency

Related collections

Similar ideas to 2. Pay your bills on time, all the time

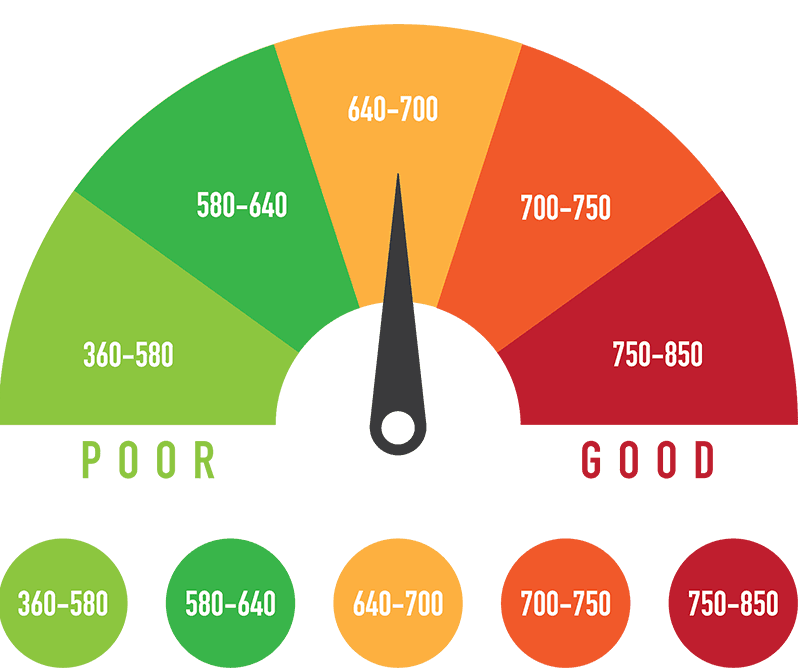

The credit score

It is a three-digit number that lenders use to assess your creditworthiness and your ability to pay your bills on time.

- The score ranges between 300 and 850.

- The higher the score, the more creditworthy you are, and the more likely lenders wi...

Debt when you're on a tight budget

There are a couple of paths you can take to pay off your high-interest debt when you're on a tight budget.

- The snowball method. For those who need to see progress, pay off the lowest balance first. You'll feel inspired to keep going.

- The avalanche me...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates