Inefficiency is a necessary condition for superior investing. Attempting to outperform in a perfectly efficient market is like flipping a fair coin: the best you can hope for is fifty-fifty. For investors to get an edge, there have to be inefficiencies in the underlying process - imperfections, mispricings-to take advantage of.

BOTTOM LINE

22

411 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about economics with this collection

The impact of opportunity cost on personal and professional life

Evaluating the benefits and drawbacks of different choices

Understanding the concept of opportunity cost

Related collections

Similar ideas

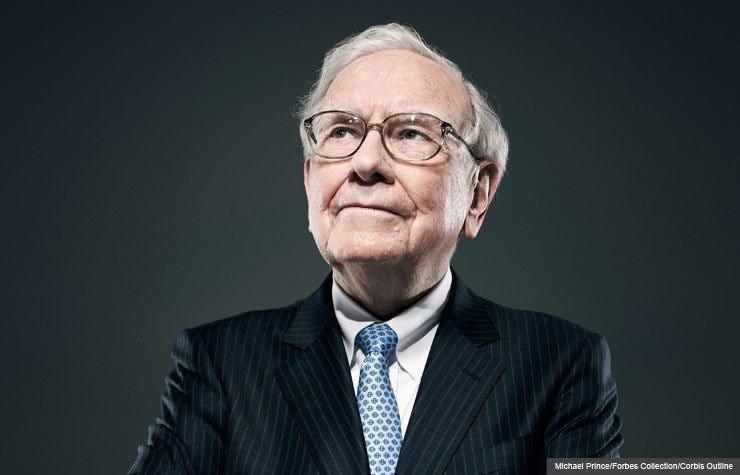

Warren Buffet's Investing Philosophy

- Buffett takes this value investing approach to another level.

- Many value investors do not support the efficient market hypothesis (EMH) . This theory suggests that stocks always trade at their fair val...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates