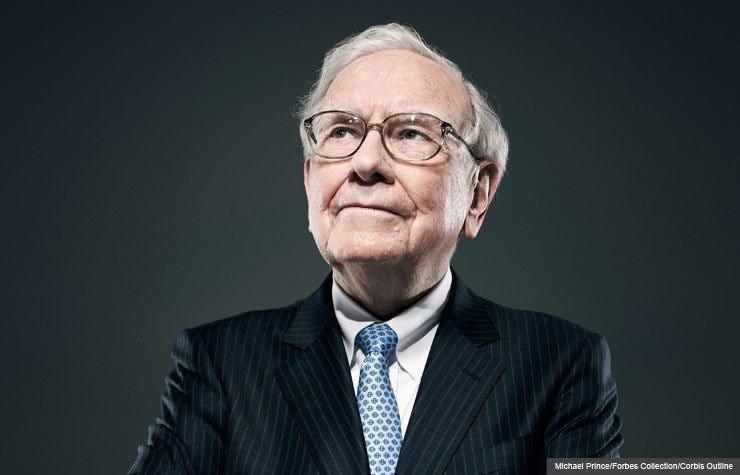

Warren Buffet's Investing Philosophy

- Buffett takes this value investing approach to another level.

- Many value investors do not support the efficient market hypothesis (EMH) . This theory suggests that stocks always trade at their fair value, which makes it harder for investors to either buy stocks that are undervalued or sell them at inflated prices.

- Investors like Buffett trust that the market will eventually favor quality stocks that were undervalued for a certain time.

895

5.12K reads

CURATED FROM

IDEAS CURATED BY

Lawyer turned Artist Visionary Curator & Gallerist. Empowering self-love and joy through art & words. www.innerjoyart.com 💝 Instagram : dymphna.art

The idea is part of this collection:

Learn more about strategy with this collection

How to analyze churn data and make data-driven decisions

The importance of customer feedback

How to improve customer experience

Related collections

Similar ideas to Warren Buffet's Investing Philosophy

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates