The Causes of a Budget Deficit

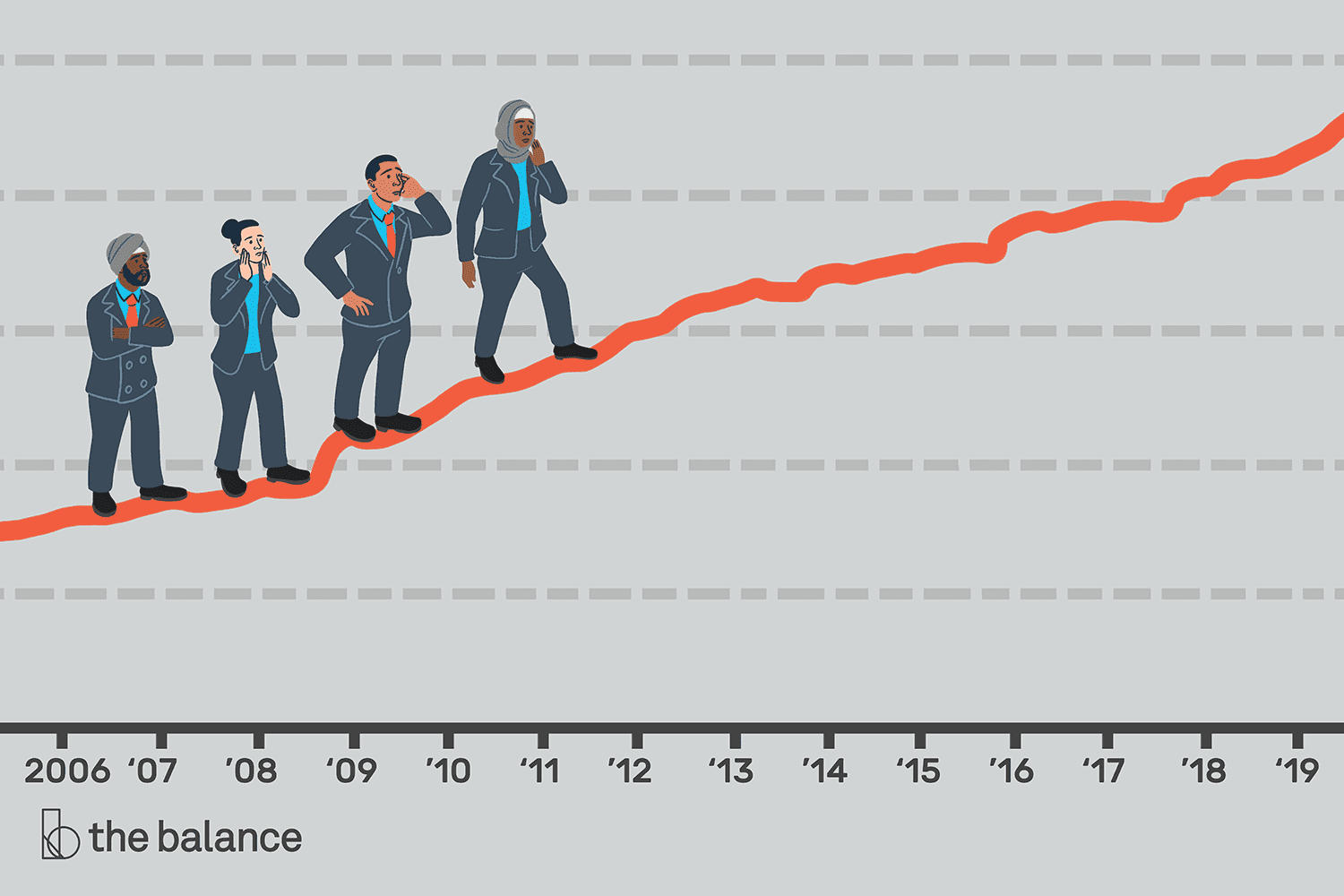

The main cause of a budget deficit is: spending more than what you're making!

However, when it comes to large scale-spending, like how the government spends, it can be difficult to track due to low taxes and high spending.

8

26 reads

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

Understanding the basics of cryptocurrency

How to store cryptocurrency securely

Risks and benefits of investing in cryptocurrency

Related collections

Similar ideas to The Causes of a Budget Deficit

Reducing Budget Deficits with Governments

In order to reduce the budget deficits that's happening with the government, they can do the following:

- Increase the taxes, particularly on the wealthy, as advocated by a large group in order to increase federal revenue therefore offsetting the deficit.

- Stimulate economic growt...

A Monthly Budget For Your Money

No matter how little or how much money you earn, creating a monthly budget is one of the most important aspects of managing your finances. What gets measured gets managed.

Having a budget doesn't stop you from spending money the way you want it to, but works like a partne...

Sticking to a budget

Once a budget is set up, it is not always that easy to stick to it. But that doesn't mean you have to give up because you've failed once or twice.

- Remember the big picture. A budget keeps you out of overwhelming debt and help you build to financial freedom.

- ...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates