Diversification

A diversified portfolio ensures that your capital is spread across a variety of investments. It ensures that you are not reliant on a single investment or industry for all your rewards. Fortunately, there are multiple asset classes to invest your money into, such as equity or bonds. It reduces your exposure to market risk and smooths out the peaks and valleys of investment trips. As a result, diversification is the guidewire that stops your investment portfolio from going off the rails especially when there’s a downturn in the market.

227

2.51K reads

CURATED FROM

IDEAS CURATED BY

Every investor’s principal goal is to reduce all possible investment risks while simultaneously increasing investment opportunities. Learn all about diversification and untold secrets. This will help anyone start their investment journey.

“

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to create a diversified portfolio

How to analyze stocks and bonds

Understanding the basics of investing

Related collections

Similar ideas to Diversification

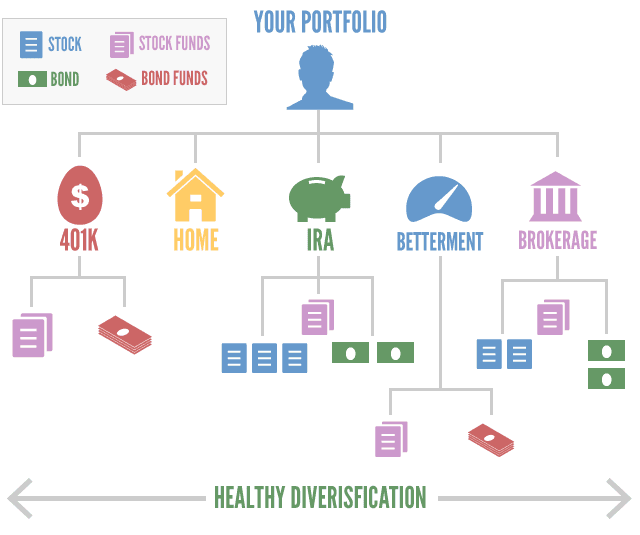

Portfolio and Diversification

- Your portfolio reflects your long-term wealth building investment strategy – not the short term. It includes everything you own. Your retirement accounts, your investment accounts, even your home are types of investments.

- Diversification is a way to describe owning mult...

6 ideal investments for beginners

- If you have a 401(k) or another retirement plan at work, it’s very likely the first place you should put your money— especially if your company matches a portion of your contributions.

- A robo-advisor. These services manage your investments for you using computer algorit...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates