4. Negotiate A Lower Interest

The better your credit card score the lower interest you should have to pay. If your credit score has improved and you have always cleared your bills on time, it might be time to give your credit card issuer a call. Most credit card issuers provide varying interest rates to cardholders based on their credit score. Look up your credit score by logging into your credit card issuers site then compare with the varying interest rates your issuer offers to find where you belong.

3

3 reads

CURATED FROM

IDEAS CURATED BY

Writer, artist, Accountant and a forever learner. Learning, loving, Hoping.

These Ideas show how to enjoy the rewards that come with using a credit card while also avoiding the threat of drowning in debt.

“

Similar ideas to 4. Negotiate A Lower Interest

Week 1: Optimize Your Credit Cards

A great place to start because it can have a big impact on your finances:

- Set up autopay to pay your CC bills

- Call to waive any past credit card fees

- Negotiate a lower APR

- Build credit history by keeping credit lines open

- Increased your credit allowance

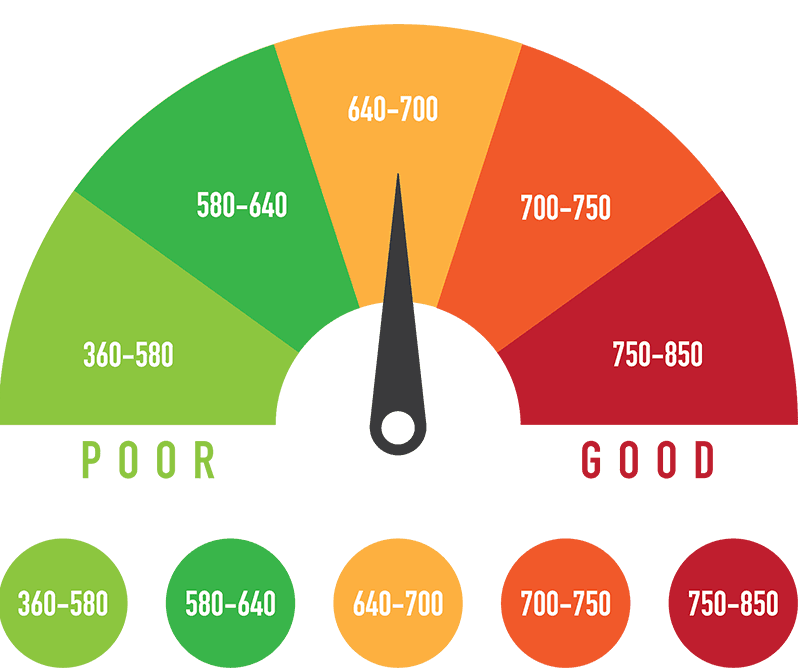

The credit score

It is a three-digit number that lenders use to assess your creditworthiness and your ability to pay your bills on time.

- The score ranges between 300 and 850.

- The higher the score, the more creditworthy you are, and the more likely lenders wi...

Ways to budget when you're broke

- Avoid immediate disaster. Request bill extensions or payments plans from creditors.

- Prioritize bills. See which bills must be paid first and set up a payment schedule based on your paydays.

- Ignore the 10% savings rule. It...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates