Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

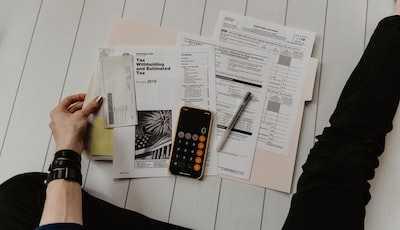

How to Avoid Piling Credit card Debts

Most people assume that owning a credit card means that you'll be swarmed in debt but this is not always true. Let's explore the reasons why.

4

20 reads

1. Read the Fine Print

Reading through the terms and conditions that come with opening a new credit card is important so you can ensure that you are getting favorable terms compared to what competitors are offering (this would require you do a little digging beforehand). For instance, you can find out what interest rates other issuers are offering and at the risk of stating the obvious, go for the credit card with the lowest interest rate.

3

7 reads

2. Avoid Cash Advances

Credit card issuers prefer that you use your card for making purchase payments, if instead, you withdraw cash at an ATM, for instance, you get charged a transaction fee, finance charges and a higher interest rate. It’s the most expensive transaction you can make with a credit card.

3

10 reads

3. Avoid Putting Medical Bills On Your Credit Cards

Medical bills may show up unexpected but putting them on your credit card is not the answer. Doing these will cost you a lot of money in interest instead, call your doctor or hospital’s billing department and ask about your options, hospitals usually have a structure for interest-free monthly payment plans.

3

6 reads

4. Negotiate A Lower Interest

The better your credit card score the lower interest you should have to pay. If your credit score has improved and you have always cleared your bills on time, it might be time to give your credit card issuer a call. Most credit card issuers provide varying interest rates to cardholders based on their credit score. Look up your credit score by logging into your credit card issuers site then compare with the varying interest rates your issuer offers to find where you belong.

3

3 reads

5. Stay on a budget

Consumers are more likely to spend more money when they pay by credit card, this is said to be because people do not experience the abstract pain of payments. Staying on a budget is all based on your self-regulation but you can consider applying the following tips:

Monitoring your payments, removing the autofill card option from your online shopping option, never using more than 30% of your available credit. Added to that If you can’t afford it without a credit card don’t buy it, limit the number of credit cards you have so your payments become easier to track.

3

11 reads

6. Link a bank account & Turn on Autopay

Paying off your balance each month helps you avoid interest completely and improves your credit score. Using an autopay feature ensures that you never miss a payment and therefore never have to worry about paying extra in interest.

3

4 reads

7. Have backup savings or investments

Emergencies are one of the reasons people go into credit card debt therefore building a safety net by saving or investing in appreciating assets will ensure that whatever the future throws at you, you’ll have the capacity to return a serve.

3

4 reads

IDEAS CURATED BY

Writer, artist, Accountant and a forever learner. Learning, loving, Hoping.

CURATOR'S NOTE

These Ideas show how to enjoy the rewards that come with using a credit card while also avoiding the threat of drowning in debt.

“

Similar ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates