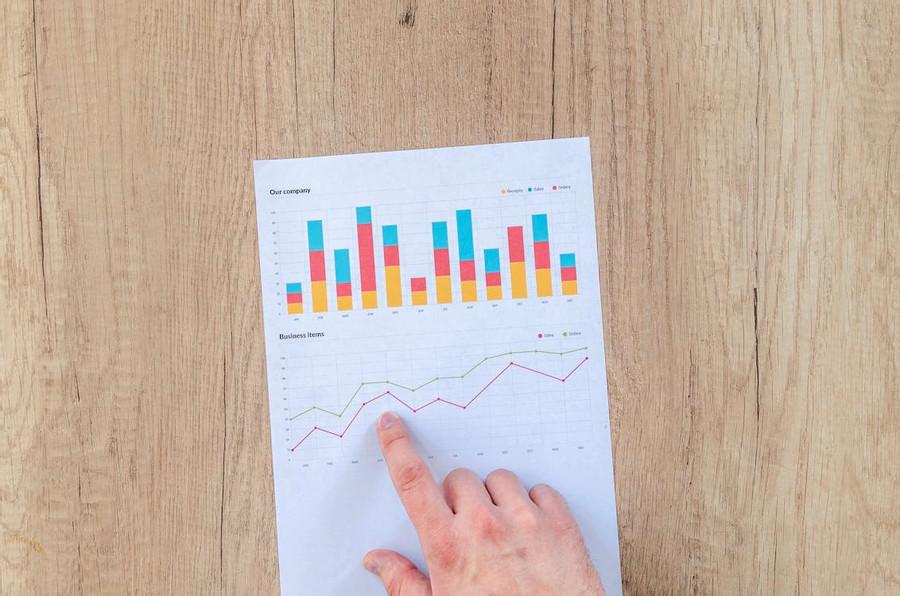

Make a List of Your Monthly Expenses and Categorize Them

Create a monthly tabulation that lists your subcategories after you've categorized your spending categories. Include a space at the bottom of the table to detail your income.

Subtract your total expenditure from your total income to discover your monthly savings once you've put your monthly transactions into each area.

Let’s say you spend $80 on publications you don’t read, and your hourly pay is $10. The realization that you spent eight hours of your life energy on the purchase may cause you to reconsider your decision the next time you pass a magazine stand!

782

2.62K reads

CURATED FROM

IDEAS CURATED BY

Time, Money And Life: Attain financial freedom.

“

The idea is part of this collection:

Learn more about books with this collection

How to make rational decisions

The role of biases in decision-making

The impact of social norms on decision-making

Related collections

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates