What to do with the saving portion?

Dont just waste the amount you saved on any desire.You shoud either

1)You should try to pay back your debts as fast as you can.

2)Try to acquire safe assets.Assets which have a good possibility of giving return.Dont expect a 100% return even 7 or 8% is enough.Dont get greedy

6

103 reads

CURATED FROM

IDEAS CURATED BY

Financial education

“

The idea is part of this collection:

Learn more about books with this collection

The balance between personal and professional effectiveness

Proactivity versus reactivity

The importance of defining your path in life

Related collections

Similar ideas

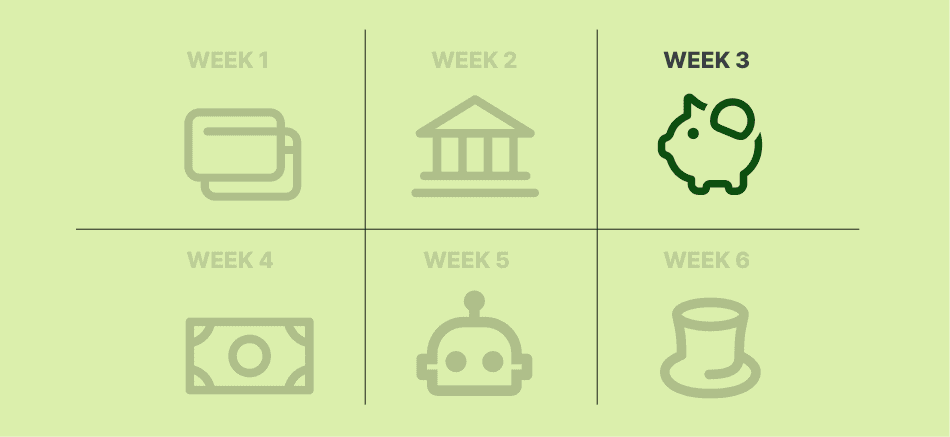

Week 3: Open 2 Investing Accounts

Open:

- a 401(K) account

- a regular investment account.

Next:

- If your employer offers a 401(k) match, invest to take full advantage of it. Contribute enough to get 100 percent of the match.

- Pay off debts. This give you a significant instant return.

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates