When it comes to financial independence, people often talk about increased salary or how much they need for a comfortable retirement.

It’s good to have goals for your savings, income and retirement fund, but it’s unhelpful when we don’t consider why we’re working towards financial independence in the first place.

8

94 reads

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to manage risk

How to analyze investment opportunities

The importance of long-term planning

Related collections

Similar ideas

Benchmarks Can Raise Stress

Financial experts often use general benchmarks to set standards for financial wellness, such as an emergency savings fund covering three to six months of expenses, or the amount needed for retirement.

But if you are feeling financial stress, these targets can feel intimidating. Overly ...

Guilt is an informative emotion

It’s often a sign we’re not acting in accordance with our values.

The guilt of not working stems from two places:

- From the fact that we value working hard.

- We consider the opportunity cost of our actions whenever we’re not working—what we...

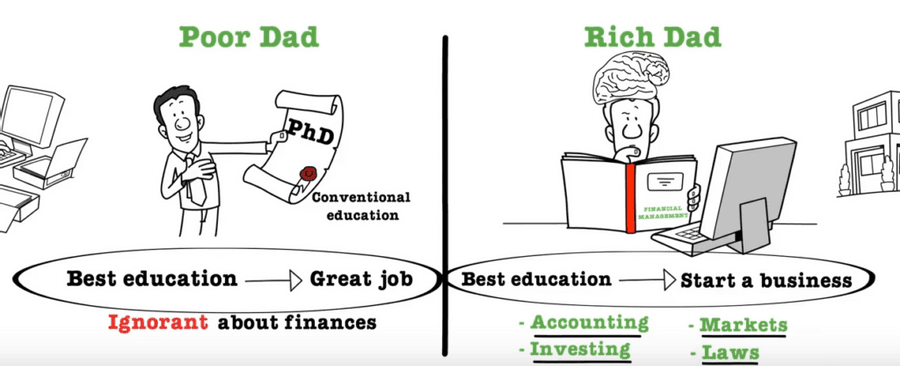

“Poor dad” vs "Rich Dad" Mentality

The “Poor dad”, a stereotype for the regular salary man, believes that one should work for money as an employee at a stable job. This mentality can trap a person into working a job they don’t love, but is willing to stick with because they have to pay the bills.

The "Rich...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates