MARKET FAILURE: This is one of a number of terms that economists use to put down the real world. Here’s the way it works:

- When things don’t go the way economists want them to, based on the laissez-faire system (see above), the outcome is explained as the result of a “market failure.” That way, it’s not the economists’ fault-they had it right, it’s the market that got it wrong.

23

190 reads

CURATED FROM

IDEAS CURATED BY

These are some insights regarding economics extracted from this book. Further more about other topics is yet to come.

“

The idea is part of this collection:

Learn more about books with this collection

How to write clearly and concisely

How to use proper grammar and punctuation

How to structure a business document

Related collections

Similar ideas

4. Redefine failure

What do you think of when you imagine failing? Not achieving a certain result or outcome?

We are taught that failure is horrible, and you should avoid it at all costs. But this is wrong! It’s not bad at all; it’s one of the ingredients to success.

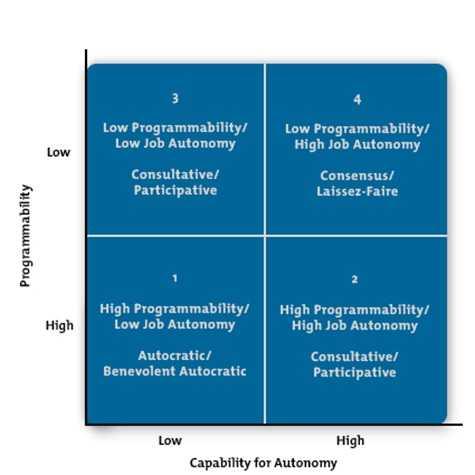

Flamholtz and Randle's Leadership Style Matrix

It shows you the best style to use, based on how capable people are of working autonomously, and how creative or "programmable" the task is.

The matrix is divided into four quadrants – each quadrant identifies two possible styles that will be effective for a given situatio...

Fail Forward

Failure is part of success and a sibling of experience. Facing failure is hard, for failing is one thing we don't want. Hence, failure is never wrong and will never be wrong unless it turns into a person. Measuring one's value by defining their capacity based on one metric is a blindsided move. ...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates