Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

The first economist

The first economist, this Adam Smith was an actual person, not some contemporary telejournalist’s pseudonym. His historic book, an Inquiry into the Nature and Causes of the Wealth of Nations (1776), propounded the idea that competition acted as the “invisible hand,” serving to regulate the marketplace.

27

501 reads

COMMODITIES: Commodities fall into two categories: goods, which are tangible, and services, which are not. An easy way to remember this distinction: these days, goods are Chinese and services are American; they make textiles; we make lawyers.

CONSUMPTION AND PRODUCTION: Consumption is what happens when you actually use commodities; production is what happens when you make them.

EXTERNALITIES: Effects or consequences felt outside the closed world of production and consumption, things like pollution. Economists keep their own world tidy by labeling these messes “externalities” then banishing them.

24

300 reads

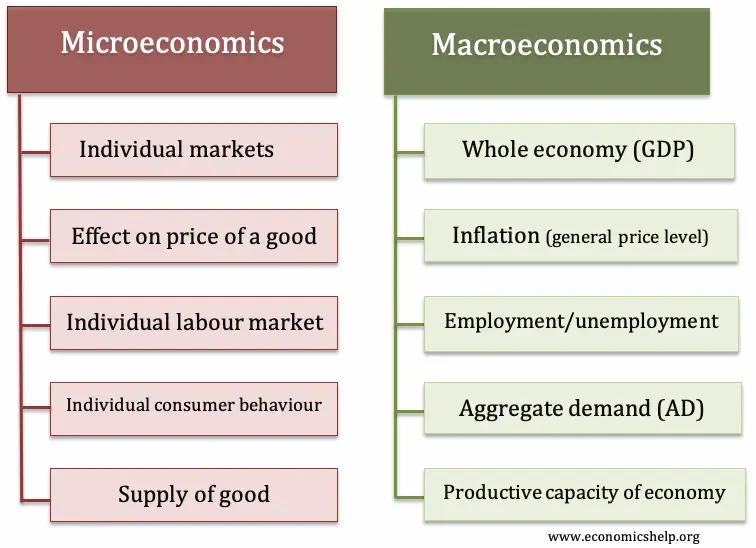

MACROECONOMICS VS. MICROECONOMICS: Further evidence of the tendency of economists to see things in pairs.

Here, “macro” is the side of economics that looks at the big picture, at such things as total output, total employment, and so on.

“Micro” looks at the small picture, the way specific resources are used by firms or households or the way income is distributed in response to particular price changes or government policies.

One problem economists don’t like to talk about is the difficulty they have in getting the two views to fit together well enough to have any practical application.

24

213 reads

MARKET FAILURE: This is one of a number of terms that economists use to put down the real world. Here’s the way it works:

- When things don’t go the way economists want them to, based on the laissez-faire system (see above), the outcome is explained as the result of a “market failure.” That way, it’s not the economists’ fault-they had it right, it’s the market that got it wrong.

23

190 reads

ECONOMETRICS: Yesterday’s high-level hustle. Econometrics used to mean studies that created models of the economy based on a combination of observation, statistics, and mathematical principles. In the Sixties, however, the term referred to a lucrative mini-industry whose models were formulated by computer and hired out to government and big business to help them predict future trends.

23

189 reads

Government, in fact, soon became the biggest investor in econometrics models, spending millions to equip various agencies to come up with their own, usually conflicting, forecasts-this, despite the fact that the resulting predictions tended, throughout the Seventies, to have about the same record for accuracy as astrology. Today, econometrics models are still expensive and still often wrong, but they’re accepted.

23

172 reads

FED: Known in financial circles as the Fed (and not to be confused with the feds), this government body, our central bank, wields enormous control over the nation’s purse strings. In fact, it’s said that the Fed’s chairman is the second most powerful man in Washington. He and his six colleagues, or governors of the Federal Reserve Board, direct the country’s monetary policy. Simply put, they can alter the amount of money (see “Money Supply”) and the cost of money (see “Interest Rates”), and thereby make or break the economy.

22

150 reads

When the Fed tightens, interest rates rise and the economy slows down. When the Fed eases, interest rates fall and the economy picks up. Or so it used to be. The balancing act is so difficult, and the Fed so mistrusted, that its actions often have a perverse effect. So much for simplicity. Many swear that the Fed is the root of all economic evil. In his landmark work, A Monetary History of the United States, 1867-1960 (coauthored by Anna J. Schwartz), Milton Friedman placed blame for the Great Depression squarely on the Fed (for tightening too much).

23

125 reads

MONEY SUPPLY: This is what the Fed is supposed to control but has a hard time doing. For decades, the Fed, and the people who make a living analyzing what money is doing, monitored the money supply because of the effect it was believed to have on the national economy.

The Fed measures the money supply in three ways, reflecting three different levels of liquidity-or spendability - different types of money have.

23

135 reads

By the Fed’s definition, the narrowest measure:

- M1, is restricted to the most liquid kind of money-the money you’ve actually got in your wallet (including traveler’s checks) and your checking account.

- M2 includes M1 plus savings accounts, time deposits of under $100,000, and balances in retail money market mutual funds.

- M3 includes M2 plus large-denomination ($100,000 or more) time deposits, balances in institutional money funds, repurchase liabilities, and Eurodollars held by U.S. residents at foreign branches of U.S. banks, plus all banks in the United Kingdom and Canada.

23

151 reads

Last time we looked, the M1 was around $1.2 trillion; the M2, $6 trillion; and the M3, $8.8 trillion. The Fed, by daily manipulation, can alter these numbers. If the Fed releases less money into the economy, interest rates rise, corporate America borrows and produces less, workers are laid off, and everyone’s spending is cut back.

When the Fed pumps more money into the economy, the reverse happens. And if it moves too far in one direction or another, the Fed can create a depression (the result of too much tightening) or hyperinflation (the result of too much easing).

24

146 reads

IDEAS CURATED BY

CURATOR'S NOTE

These are some insights regarding economics extracted from this book. Further more about other topics is yet to come.

“

Mihai-Sebastian Ioniță's ideas are part of this journey:

Learn more about books with this collection

How to write clearly and concisely

How to use proper grammar and punctuation

How to structure a business document

Related collections

Discover Key Ideas from Books on Similar Topics

10 ideas

I Will Teach You To Be Rich

Ramit Sethi

12 ideas

How to Be a Productivity Ninja

Graham Allcott

24 ideas

Eat That Frog!

Brian Tracy

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates